American Axle & Manufacturing Holdings, Inc. (AAM), (NYSE: AXL) today reported its financial results for the first quarter of 2017. In addition, AAM provided an updated 2017 financial outlook and 2017 – 2019 new and incremental business backlog to reflect the inclusion of recent acquisition activity.

First Quarter 2017 Results

- First quarter sales of $1.05 billion

- Gross profit of $210.7 million, or 20.1% of sales

- Net income of $78.4 million, or 7.5% of sales

- Diluted earnings per share of $0.99

- Net cash provided by operating activities of $62.3 million

- Adjusted EBITDA of $183.6 million, or 17.5% of sales

- Adjusted earnings per share of $1.03

- Adjusted free cash flow of $60.5 million

AAM’s net income in the first quarter of 2017 was $78.4 million, or $0.99 per share, as compared to net income of $61.1 million, or $0.78 per share, in the first quarter of 2016.

AAM defines Adjusted earnings per share to be diluted earnings per share excluding the impact of restructuring and acquisition-related costs and non-recurring items, including the tax effect thereon. Adjusted earnings per share in the first quarter of 2017 was $1.03 compared to $0.78 in the first quarter of 2016.

AAM’s sales in the first quarter of 2017 were $1.05 billion as compared to $0.97 billion in the first quarter of 2016. Non-GM sales increased to a record $347.1 million in the first quarter of 2017 as compared to $323.2 million in the first quarter of 2016.

AAM’s content-per-vehicle is measured by the dollar value of its product sales supporting our customers’ North American light truck and SUV programs. In the first quarter of 2017, AAM’s content-per-vehicle was $1,630 as compared to $1,611 in the first quarter of 2016.

AAM’s gross profit in the first quarter of 2017 increased $36.7 million to $210.7 million, or 20.1% of sales, as compared to $174.0 million, or 18.0% of sales, in the first quarter of 2016.

AAM’s SG&A spending in the first quarter of 2017 was $82.8 million, or 7.9% of sales, as compared to $75.6 million, or 7.8% of sales, in the first quarter of 2016. AAM’s R&D spending in the first quarter of 2017 was $41.0 million as compared to $30.9 million in the first quarter of 2016.

AAM defines EBITDA to be earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the impact of restructuring and acquisition-related costs. Excluding the impact of $16.0 million of restructuring and acquisition-related costs, Adjusted EBITDA was $183.6 million, or 17.5% of sales, as compared to $149.8 million, or 15.5% of sales, in the first quarter of 2016.

AAM defines free cash flow to be net cash provided by operating activities less capital expenditures net of proceeds from the sale of property, plant and equipment. Adjusted free cash flow is defined as free cash flow excluding the impact of cash payments for restructuring and acquisition-related costs and settlements of pre-existing accounts payable balances with acquired entities.

Net cash provided by operating activities for the first quarter of 2017 was $62.3 million. Capital spending, net of proceeds from the sale of property, plant and equipment, for the first quarter of 2017 was $34.1 million. Cash payments for restructuring and acquisition-related costs and the settlement of pre-existing accounts payable balances with acquired entities were $32.3 million for the first quarter of 2017. Reflecting the impact of this activity, AAM’s Adjusted free cash flow for the first quarter of 2017 was $60.5 million.

AAM’s Full Year 2017 Updated Financial Outlook

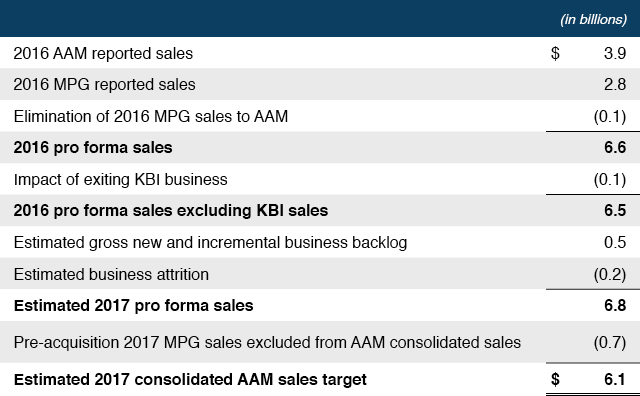

AAM’s full year 2017 financial outlook has been updated to include the impact of the Metaldyne Performance Group Inc. (MPG) acquisition, reflecting the expected financial performance of the acquired entity from April 6, 2017 to December 31, 2017.

- AAM is targeting sales of approximately $6.1 billion in 2017, which excludes MPG sales for the period between January 1, 2017 and April 5, 2017. This sales projection is based on the anticipated launch schedule of programs in AAM’s new and incremental business backlog and the assumption that U.S. Seasonally Adjusted Annual Rate of sales (“SAAR”) will be approximately 17.5 million light vehicle units in 2017.

- AAM is targeting an Adjusted EBITDA margin in the range of 17% to 18% of sales in 2017.

- AAM is targeting Adjusted free cash flow of approximately 5% of sales in 2017.

- AAM is targeting full year capital spending of approximately 8% of sales in 2017.

- We expect to incur significant costs and payments related to restructuring and acquisition-related activities as well as significant purchase price adjustments and related effects on the income statement during 2017. The impact of these has been excluded from our Adjusted EBITDA margin and Adjusted free cash flow targets.

Pro Forma New and Incremental Business Backlog

The pro forma new and incremental business backlog for the period 2017 – 2019 includes MPG’s new and incremental business backlog, including the impact of the full year 2017.

- AAM estimates the pro forma gross new and incremental business backlog to be approximately $1.5 billion for the three year period of 2017 – 2019.

- AAM assumes US SAAR to be approximately 17.5 million light vehicle units over each of the three years in the backlog period. AAM also assumes a moderate recovery in the commercial vehicle and industrial markets during this time period.

- AAM’s expects annual normal business attrition to be between $100 million and $200 million each year during the three year period of 2017 – 2019.

- In the first quarter of 2017, MPG completed the exit of the KBI wheel bearing business. The estimated impact of this exit on pro forma 2017 sales is a reduction of approximately $105 million.

- As disclosed on January 11, 2017, AAM estimates the sourcing impact of GM’s next generation full-size truck program to be a reduction of sales of approximately $175 million in 2018 and an additional reduction of sales of approximately $275 million in 2019, with the remaining impact in 2020.

The chart below shows the expected significant changes in sales from 2016 to 2017, beginning with pro forma 2016 sales of AAM and MPG through AAM’s estimated 2017 consolidated sales.