Transportation is undergoing a massive transformation with electric mobility, digitalisation, the drive towards decarbonisation, climate change and supply chain volatility. The automotive industry is responsible for a large share of the world’s overall resource consumption and generates about 5% of the world’s industrial waste. The good news here is that a shift to the circular principles of reusing and recycling materials and components mitigates, if not completely solves, many of these challenges. By applying circular principles, the automotive industry can reduce carbon emissions by up to 75% and resource use by up to 80% per person-kilometre by 2030, and reduce 66% of emissions from material production at no additional cost by 2030, according to Accenture.

The business case for companies to engage in the circular economy gets stronger by the day. Consulting firm Gartner, which several years ago declared that the circular economy would become “the only economy” by 2029, found in a recent survey that 74% of supply chain executives expect to increase profits by 2025 as a result of applying circular principles.

Increasing compliance obligations are placing additional demands on the automotive industry. Sustainability officers now have to deal with 20 times more regulations than in the past. In addition, many companies lack the comprehensive overview of greenhouse gas emissions they need to effectively calculate their Scope 3 emissions.

Nevertheless, appropriate steps can be taken to accelerate the move to circular practices:

Focus area #1

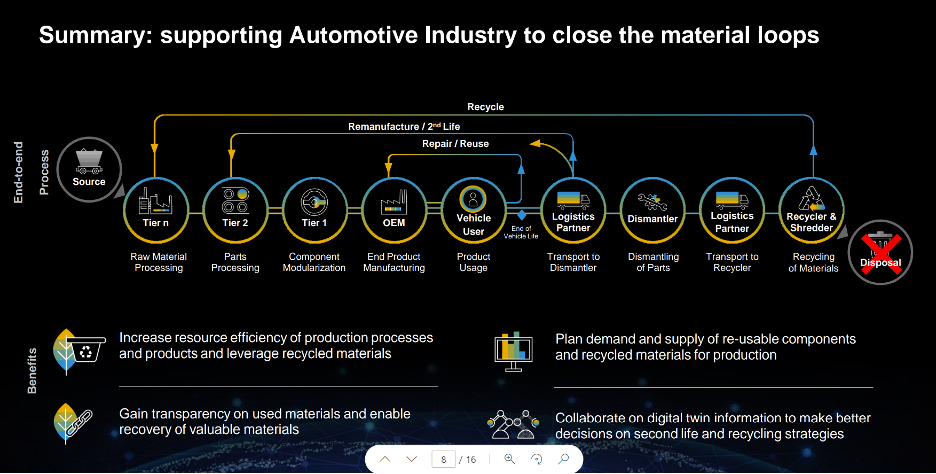

Data is the driving force in reducing carbon emissions and increasing circularity, so companies must gain transparency on used materials and enable recovery of valuable materials. The digitalisation of business processes is fundamental to facilitating traceability. The entire process from the mine to the user or recycler must be considered to close the loop into a circular Economy. The basis to gain transparency along the automotive value chain is traceability, based on digital twins enriched with corresponding product and material information.

Digital twins can be used to map a car battery across the entire life cycle. The raw material manufacturer certifies sustainability values such as origin and secondary material composition of the battery. The digital twin collects data during the vehicle use phase and provides insights and analytics capabilities for better end-of-life decision-making. Based on the aggregated data, it can be decided whether the battery is to be re-used, e.g., as an energy storage system, or whether it is to be recycled, e.g., into new raw materials which can be used for new battery production.

Focus area #2

Efforts must be made to develop frameworks, data standards, practices and processes to create new intelligent e-mobility business ecosystems and foster collaboration across the e-mobility value chain. Catena-X provides a solid example of how organisations across the automotive value chain can collaborate in a business ecosystem to lay the data-sharing groundwork for achieving carbon reduction goals with impactful and profitable circular business models.

Launched in 2021, the open and collaborative data ecosystem has grown from car manufacturers, Tier 1 suppliers and dealers to software and equipment providers and even recyclers. All are working together to develop common standards for the secure and trusted data exchange in use cases such as material traceability, carbon footprint management and circular economy.

Companies can’t meet carbon reduction targets and requirements in a vacuum, however. Catena-X provides a model for how individual automotive companies and the entire value chain can lead the world into a lower-carbon future driven by a circular economy and e-mobility. And as Gartner’s findings make clear, the business case for automotive companies to take a leadership role in the emerging circular economy is compelling.

Focus area #3

Companies must design automotive materials and components to be easily recycled, remanufactured and/or reused in advance of coming regulations like the EU Battery Passport. Under the traditional take-make-use-dispose linear product lifecycle, waste was essentially designed into products, with all the added environmental and disposal costs that involves. With advanced modelling tools, companies can analyse how specific design trade-offs affect cost, margin, recyclability, EPR exposure, carbon footprint, and other factors, giving them a clear line of sight into the relationship between sustainability choices and business success.

Regulatory and market forces are driving the automotive market in this direction, particularly as a way to manage the proliferation of batteries resulting from the rise of e-mobility. One of the biggest challenges facing members of the automotive value chain is how to bring circularity to the battery lifecycle. The purpose of the EU Battery Passport is to provide transparency and awareness and enable the shift to a circular economy. It will be an electronic record of a battery containing a comprehensive set of information collected along the battery life cycle. The challenge here is exactly to get the required data from all different sources especially from the multi-tier supply chain and consolidate them to the standardised format of the battery passport.

For automotive companies, advanced modelling and analysis tools such as digital twin can be extremely valuable during the design and engineering of a vehicle, system, or component. They can help identify pathways that emphasise regeneration, waste elimination, and keeping materials in use longer—in essence, designing for modularity, extended service life, reuse, recycling, and/or end-of-life reuse.

Focus area #4

Industry must create secondary markets where manufacturers and suppliers can source reliable recycled and/or remanufactured components and materials, and then actively participate in those markets. Designing mobility products, components and systems for modularity, recycling, remanufacturing and reuse sets the stage for the fourth fundamental cornerstone for companies to thrive in the circular economy: creating viable secondary markets for materials and components.

As a result of new policies such as the EU Battery Directive, there’s more pressure on the e-mobility value chain to address the issue of battery recycling. It’s a high priority for Catena-X, which is working to develop the Digital Product Passport, a standard way to track and report sustainability data associated with batteries throughout their lifecycle. Developments like this are laying the groundwork for secondary market platforms for buying and selling batteries and the raw materials that go into them, as well as alternators and secondary materials like aluminium and polyurethane.

Traceability of materials (by serial number, batch, etc.) will be critical to the success of these secondary markets, from the mining of raw materials at one end of the journey to their remanufacturing, recycling and reuse at the other. Transparent data on the origin and carbon footprint associated with specific parts, components and materials must be readily available and verifiable, not only for ESG purposes, but also to give recyclers the insight they need to make decisions about reuse, recycling and/or recovery strategies for automotive components.

Ultimately, capabilities like these will help automotive companies to meet their carbon reduction responsibilities, differentiate their brand, and reinvent themselves as circular, sustainable, and profitable mobility providers.

About the author: Nadine Kanja is Solution Head of SAP Industry Network for Automotive and Catena-X at SAP SE