The language we use around cars and car usage is quickly becoming antiquated as the industry goes through one of its biggest transformations since the introduction of the Ford Model T. The phrase ‘going to a dealership to buy a car’ alone contains two anachronisms. Today, very few people ‘buy’ a car in the traditional sense. According to the Finance and Leasing Association, last year in the UK, 93% of new car transactions to private individuals were financed.

Additionally, the word ‘dealership’ assumes you go there to strike a deal, i.e haggle for the best price. Increasingly, however, car companies are moving to direct sales. In this model, rolled out initially for electric cars by brands such as Volkswagen, the car companies themselves are doing the selling, either via their ‘agents’, what we used to know as dealers, or online. The idea is that it gives the customer a much wider range of options to get into a car, none of which require haggling skills.

Ford is known for having made cars cheaper with its repeatable manufacturing process. However, it was the innovation from General Motors—allowing cars to be purchased on finance—that really opened car accessibility to the masses. Right now, there is another radical change in the way the services that constitute mobility are being provided, paid for and bundled together. Personal mobility is turning into something you can access on demand.

Many customers no longer measure their automotive needs in years. Rather, they want the same flexibility they find in other digital subscriptions, like Netflix or HelloFresh

The shift is coming because automotive brands are realising that many customers no longer measure their automotive needs in years. Rather, they want the same flexibility they find in other digital subscriptions, like Netflix or HelloFresh. This flexibility applies not just to the car itself but to all things automotive, including the services offered within the car and those connected to ‘ownership’, such as insurance.

With newcomers like Tesla changing the game, incumbent brands must react now to the evolving customer needs or risk losing their competitive edge. The rich heritage of brands like Land Rover, BMW, Ford or Renault now has to be supplemented by offering a much more digital-led experience that seeks to remove many of the pinch-points within traditional ownership.

Car insurance is one of those pinch-points as it exists today. For one thing it usually stands apart from the process of acquiring a new car. It’s something customers usually purchase, grudgingly, after the transaction and before delivery. The process requires them to guess at their year ahead, whether that’s the mileage driven, type of driving (business, personal or both), or even job status.

In a more flexible future, however, this will become more embedded into the transaction process. Rather as the order screen asks, ‘would you like fries with that?’ it’ll become an option box to tick. And it’ll no longer require you to guess your motoring future or make sweeping assumptions about your driving. It’ll know as you drive.

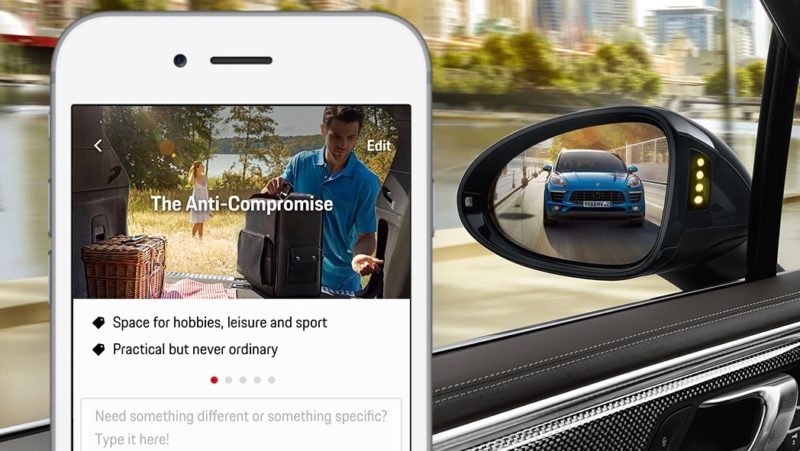

The shift is being facilitated by connectivity. The ability to interrogate cars through their sensors after they’ve left the showroom allows car makers and service providers to extract data and interpret that for the benefit of the customer. The connectivity and digital interaction is also enabling this new flexibility within the world of car ‘ownership’. The subscription model offered by the likes of Porsche, Volvo and Jaguar Land Rover allows customers to change cars at a quicker rate than traditional financing permits. That requires car companies and other business entities to remotely keep track of the fleet.

If the first driver of a new Range Rover decides it’s time to upgrade to an even newer model six months into their subscription, then the company that ultimately owns the car will need to reassign it to the next customer, keeping a careful eye on it remotely for total mileage and signs of excess wear and tear.

The same is true of insurance. The subscriber will not be pleased to hear that the flexibility to change vehicles offered by their car brand triggers a policy amendment fee from their insurer because subscriptions don’t fit the latter’s business model. Insured drivers should be able to update their policy seamlessly, either automatically or via a few taps on an app—like they do everything else

And what if the next vehicle is not even a car? Micro-mobility subscriptions service Swapfiets in the Netherlands for example offers bikes and e-bikes, while electric scooters and cargo bikes are also becoming car substitutes for certain journeys. Insurance will need to follow that trend and allow people to make the swap without hassle.

The shift to autonomous driving also presents another interesting challenge to insurers. If they aren’t embedded into the process when the customer gets into the car, whether for an afternoon or for six months, then splitting out the autonomous function is going to be very difficult.

Volkswagen has spoken about offering autonomous functions in customer cars as a pay-as-you-go service in the future

That’s because autonomy will be a choice made by the driver, at least initially. Volkswagen has spoken about offering autonomous functions in customer cars as a pay-as-you-go service in the future. It envisages charging around €7 (US$8.30) for going hands-free, for example on a long holiday drive. If that option is triggered, insurance needs to adapt instantly, and again seamlessly. In the future it might be that, rather than the exception, autonomous is the norm, and that insurance needs to adapt if you’re planning to take control on an interesting stretch of road.

This scenario immediately hands the advantage to brands providing embedded insurance. The one that calculates the effect of the driver’s decision-making on their risk status in real-time is also going to offer the best price to the customer, because they’ll know everything. If an incident does occur, the data from the car’s sensors will quickly determine what needs repairing and when, and give a reliable estimate of how much it will cost—even automating the order and delivery of the necessary parts.

Business models are even harder to shift than language when it comes to automotive, an industry that has traditionally been slow to react to change. The current transition to electric, connected, autonomous and flexible ownership however is happening at such speeds that legacy brands will struggle to adapt without embedding experiences far more deeply into the customer journey.

About the author: Darius Kumana is Chief Product Officer at WRISK