Demand for connected vehicles, advanced driver assistance systems (ADAS), and autonomous driving (AD) are all prominent factors driving automotive software development today. The global market’s value is expected to reach US$117bn by 2032—up 241% from 2023, according to Precedence Research.

However, unlike in the tech industry, automotive players must carefully balance the desire for a fast time-to-market with the safety considerations of deploying new ADAS/AD features on the road. “The software needs to pull together radar, cameras, LiDAR, compute platforms, and other hardware,” says Aaron Jefferson, Vice President of Product at Luminar Technologies. “The big challenge is engineering software that works first time out of the box.”

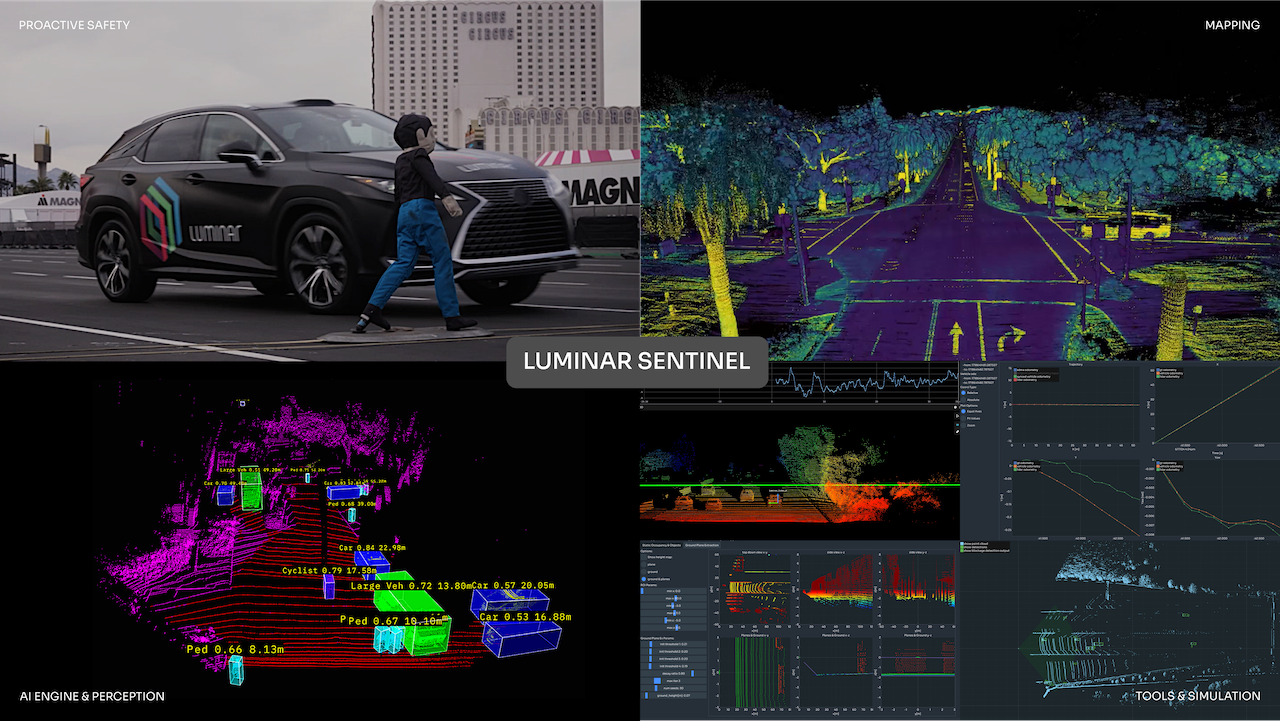

More frequent industry discourse around software-defined vehicles (SDVs), he tells Automotive World, can give the false impression that this challenge is now easily surmountable. “In fact, it still takes a lot of design, development, and testing to make sure software won’t glitch once it’s in use.” As such, Luminar has been developing a new stack—Sentinel—to help provide automakers with the toolkit necessary for safely realising next-gen vehicle functionality.

Assessing true value

Although it’s a Tier 1 more commonly associated with LiDAR and machine perception technology, Luminar is pushing past a strict focus on hardware. “The value of LiDAR is ultimately what you do with the data it generates,” comments Jefferson. “OEMs often cycle alternately through wanting to create ADAS/AD software in-house and partnering with a third party. The truth is very few have invested in software tied to high-quality LiDAR data.” It was by identifying this gap in the market that Luminar arrived at the idea for Sentinel.

Development started based on perception software used for the company’s LiDAR sensors: a point cloud—collection of data points arranged in 3D space—which facilitates the identification of sidewalks, lane boundaries, pedestrians, vehicles, etc. “From there, it was a case of deciding how to package it in a stack and match it to the KPIs customers might want to track, such as accuracy of object detection in low levels of lighting.” This took some time: an initial Sentinel prototype with limited capabilities emerged in 2021. A commercially viable version was launched in July 2024.

The final product consists of a compute platform based on an Nvidia Orin processor, a LiDAR sensor with core software and point cloud output, a perception stack, and 3D mapping and localisation features. This suite is then integrated with an existing system. Sentinel’s capabilities are diverse—or “à la carte” in Jefferson’s words—as each automaker’s initial architecture and project goals will invariably differ from another’s. “Luminar wants to provide a ready-made kit so that OEMs can develop the safety and functionality of their software without having to invest a billion dollars in their own,” he states.

Broadening tech horizons

In April 2024, insurance firm Swis Re published an audit of Luminar’s LiDAR combined with a pre-release version of the Sentinel stack. In total, 800 individual tests—including car-to-car and car-to-motorbike incidents and vulnerable road user scenarios—were conducted on a vehicle with SAE Level 2 ADAS functions. Swis Re found that a vehicle equipped with Luminar’s technology was 25% less likely to be involved in a collision than an equivalent vehicle without it, and overall collision severity was reduced by up to 40%.

While this research is promising, Jefferson notes that Sentinel cannot be used simply as a plug-and-play shortcut for bringing the next generation of ADAS/AD solutions into production immediately. Rather, it is complementary software for helping more mature players assess and improve LiDAR-based features already under development. Although it is still too early for the company to report on individual customer use cases, these are currently ongoing.

Much in the same way that Luminar partnered closely with Volvo Cars to integrate LiDAR sensors seamlessly into the roofline of its EX90, Jefferson believes an ongoing industry dialogue can help marry ADAS/AD software with brands’ wider goals. “Based on our back and forth with an automaker in the Asia-Pacific region, it’s already become clear that new software solutions can help manufacturers realise the unexplored potential of their existing hardware.” It is by capitalising on these broadened horizons, he adds, that future SDV innovation could be realised.

Democratising LiDAR

Although the industry has not yet reached consensus on what sensor hardware or fusion will enable mass market Level 4+ autonomy, many consider LiDAR’s functionality valuable for building consumer trust during a difficult time in the market. High-profile incidents involving AD systems have decelerated interest among stakeholders, but a software-driven re-examination could help development regain momentum. From an engineering perspective, Jefferson states, “we haven’t even scratched the surface of what LiDAR can deliver.”

We’re going to see [LiDAR’s] democratisation across all vehicle segments as software helps deliver the sensor’s true value

In April 2024, the US National Highway Traffic Safety Administration stated that automatic emergency braking (AEB) must become standard—rather than a luxury—in all cars and light trucks by 2029. Jefferson anticipates that LiDAR technology expanded and improved through software will play an important role in fulfilling this requirement, setting the foundation for Level 2 ADAS functionality and beyond. “The challenge is that this will represent a paradigm shift from the camera and radar fusion with which many OEMs are comfortable.” However, he believes the rigours of a rapidly changing industry make previous solutions inadequate.

One of the most attractive prospects of SDVs is that they can unlock previously inaccessible monetisation opportunities. For the first time in the automotive industry’s history, vehicles could become more valuable with time, not less, as new features can be added quickly through software. For ADAS/AD, automakers will need a system that provides foundational safety for the mass market while also containing the scalability for advanced AD features. Software stacks based on LiDAR, concludes Jefferson, can help fulfil this need. “LiDAR is fundamentally a safety technology, not just a facilitator of autonomy; it works equally well for both. We’re going to see its democratisation across all vehicle segments as software helps deliver the sensor’s true value.”