The powertrain landscape is changing fundamentally across global automotive markets and electrification—the transition from combustion engine-powered powertrains to electric powertrains—is at the heart of this development. Optimistic forecasts expect between 30% and 50% electric powertrains by 2030 in most regions. This includes battery-powered electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), fuel-cell electric vehicles (FCEVs), and hybrid electric vehicles (HEVs). Mild hybrid electric vehicles (MHEVs) represent a technological leap in the other part of the automotive market—that is, vehicles solely based on a combustion engine. What technological and market opportunities can be expected from this technology in the rapidly changing powertrain landscape?

From today’s viewpoint, combustion engine-based powertrains will remain dominant at least for the coming decade—yet with significant differences across key markets as the speed of electrification varies. In Europe and China, the share of electric powertrains* could increase to about 45 to 50% by 2030. In the US, electrification could take place at an initially lower pace, with later acceleration to a share of about 35% electric powertrains by 2030. The COVID-19 pandemic is accelerating electrification in Europe and China due to additional government incentives, unchanged stringent regulation, and an increased appetite for sustainable mobility. In contrast, COVID-19 is slowing down electrification in the US due to relaxed regulation, low oil prices having a significant impact on gasoline prices, and several delayed or halted EV model launches by US-based OEMs.

Mild hybrid technology brings higher efficiency and lower running costs to combustion engines and could therefore provide promising opportunities for OEMs, suppliers, and customers until electric powertrains become ubiquitous.

MHEV technology offers key advantages in combustion engine powertrains now

‘Mild hybrids’ typically refers to vehicles with at least one electric 48-volt (48V) motor that assists a classic internal combustion engine (ICE) and a 48V battery that is charged by an electric generator recovering excess mechanical energy. Mild hybrid technology can be combined with both gasoline and diesel engines; however, diesel mild hybrids only play a role in Europe.

MHEV architectures

There are different powertrain system architectures for mild hybrids, as shown in Exhibit 1, but two architectures are most relevant. In the P0 architecture—by far the most common architecture—the 48V motor is linked to the combustion engine with an accessory belt. In the P2 architecture, the 48V motor is connected to the crankshaft. As Exhibit 2 shows, current projects reflect a much lower production volume of the P2 architecture in the near future, but its importance could increase as batteries and engines become more powerful in the coming years. Other architectures, such as the P1 architecture—similar to the P2 architecture but with the 48V motor directly connected to the combustion engine—have not made their way into the mass market yet.

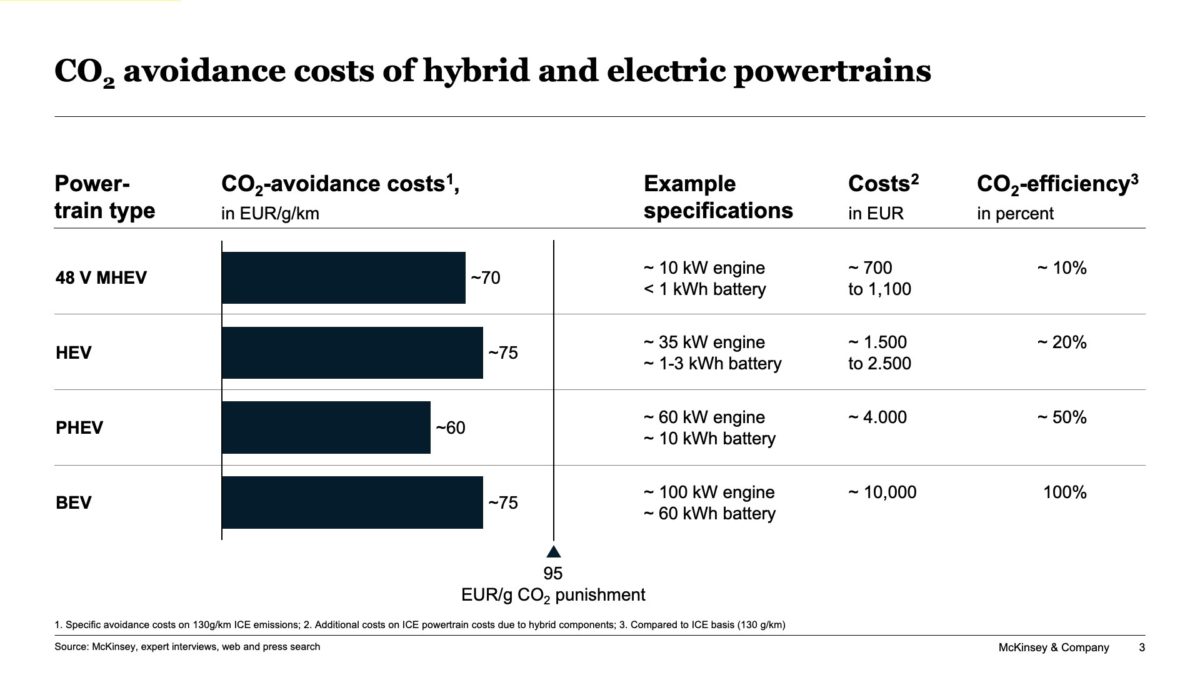

What all MHEV architectures have in common is that the ICE setup remains mostly unchanged—hence, MHEVs require the same components as existing ICE models, plus additional 48V components. This includes the 48V motor and generator, the inverter, the 48V battery (typically <1 kWh), and the DC-DC converter that connects the 48V electric system to the conventional 12v electric system. Altogether, typical MHEVs currently cost about €700 to €1,100 per vehicle on top of the ICE base.

MHEV advantages

MHEV powertrains can deliver efficiency gains of up to 5-15% compared to regular ICEs. This efficiency gain results from the recovery of energy during braking and the electric efficiency gained from having a 48V wiring system compared to a 12v wiring system. Connecting peripherical components via the 48V wiring system reduces the power loss due to electric resistance—an advantage of growing importance given the increasing connectivity in cars.

The efficiency advantage of MHEVs is relevant for both OEMs and consumers. For OEMs, ~5-15% higher efficiency means lower CO2 emissions at manageable additional vehicle cost. The CO2 avoidance costs of MHEVs total around €70 per g CO2 per km (Exhibit 3), landing in between those of PHEVs and BEVs. Thereby, MHEVs offer an attractive way to reduce the average CO2 emissions of OEMs’ product portfolios.

For consumers, this efficiency advantage pays off in the total cost of ownership (TCO). Although the additional costs for MHEV technology result in a slightly higher purchase price, the running costs are lower due to less fuel consumption. Equipped with MHEV technology, gasoline powertrains become an interesting alternative to diesel powertrains for consumers with a high annual driving mileage since they provide similar advantages (lower running costs for fuel that offset a higher engine cost at a certain mileage).

MHEV market share development

The 48V MHEV market share is clearly increasing and expected to provide significant growth over the next decade. In Europe, MHEVs are expected to almost completely replace pure ICE vehicles by 2030 and see their market share increase to more than 45% of the total light vehicle market. In China, MHEV market share could rise at a similar pace, reaching about 40% of the total light vehicle market by 2030. And in the US, where the transition from pure ICE to MHEV technology is going to occur later, the MHEV market share could still reach levels of more than 45% by 2030 in a market where the share of combustion engines is still higher than in Europe and China.

Of course, MHEVs are more relevant in Europe and China than in the US since CO2 regulation is much stricter in these regions than in the US. In addition, diesel vehicles are becoming increasingly expensive, given tightening emissions regulation (e.g., the upcoming Euro 7 norm) that requires extensive after-treatment systems. Gasoline-powered 48V MHEVs could step in here since they provide similar fuel efficiency advantages at manageable additional cost (the cost for 48V MHEV technology is typically lower than the price difference between a gasoline and a diesel engine).

Future opportunities for OEMs

For many OEMs, the higher fuel efficiency is a critical lever they can pull in order to comply with decreasing CO2 fleet emissions targets (e.g., 95g to 59g CO2 from 2021 to 2030 in the European Union). Recent moves OEMs have made to introduce 48V mild hybrid technology into existing ICE vehicle portfolios (e.g., VW Golf, Audi A4, BMW 3 Series, Mercedes-Benz C-Class, Fiat 500, Volvo 60-/90 Series, Kia Ceed, Ford Kuga) on a large scale underline the potential of this technology.

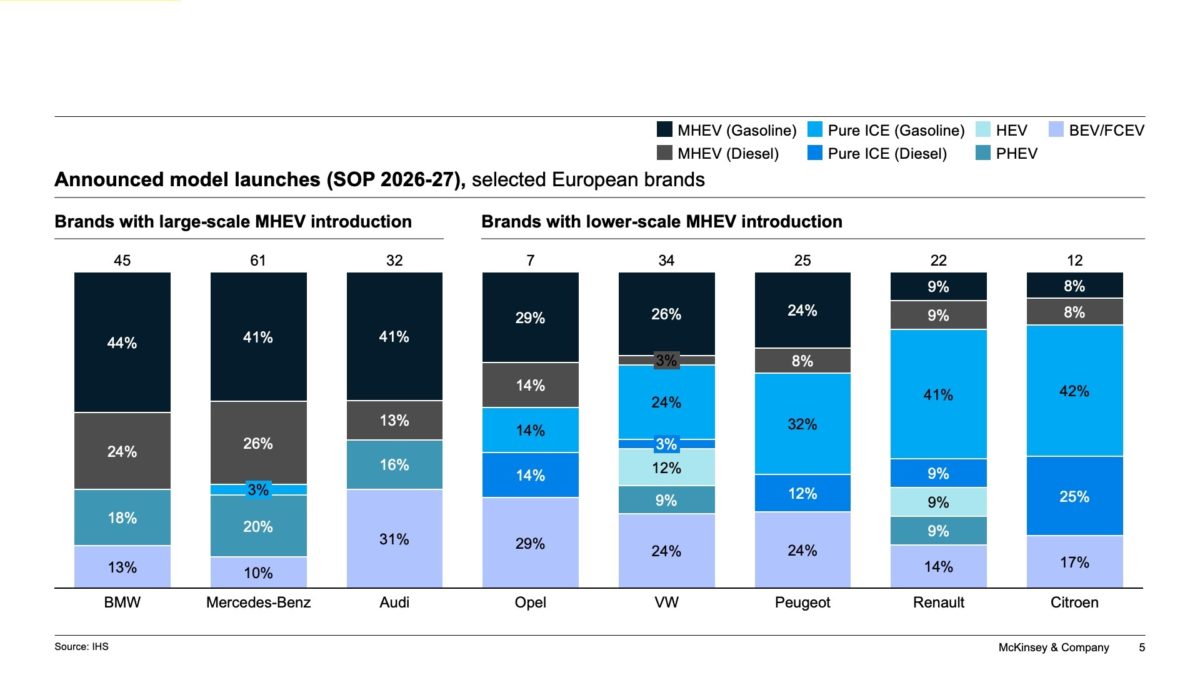

When looking at announced upcoming model launches, one can observe two different MHEV footprints in the production portfolio of European auto brands (Exhibit 5). Manufacturers of some brands—especially those with premium brands—count on large-scale MHEV introduction during this decade. Given that the upcoming ICE engine launches are likely to be the “last generation” and many will be equipped with 48V technology, these engines are likely to remain in the market for a long time.

In contrast, manufacturers of another set of brands plan to introduce MHEV on a much lesser scale and still heavily rely on pure diesel and gasoline engines. While manufactures may initially focus their introduction of MHEVs on Europe in order to comply with tightening CO2 emissions limits, over time, the same MHEV vehicles will also be sold to other markets in which MHEVs are not yet highly present.

Since MHEVs require 48V components in addition to ICE vehicle components, the MHEV market offers enormous growth potential to suppliers. Given the increasing number of MHEV models launched and expected growth of global MHEV production (Exhibit 2), the demand for MHEV components is increasing rapidly as well. Overall, revenue from components for MHEV powertrains is expected to grow by about 80% from 2018 to 2025 (Exhibit 6), which represents the fastest growing powertrain component market.

Market opportunities for suppliers

Moreover, the market for 48V components is not as fragmented or competitive as the high-voltage (HV) components market (i.e., for BEV and PHEV components). The HV market shows a high competitive density with typically more than 15 suppliers of typical HV components battling aggressively for market share in a growing market (yet with growth rates of only 20-25% compared to 80% for MHEV). In contrast, there is typically only a handful of suppliers in the 48V components market, which for many product categories offers high double-digit growth. To profit from this opportunity, suppliers should work to leverage their system competence in ICE powertrains to design innovative MHEV components.

Outlook

From McKinsey’s perspective, MHEVs will play a major role in a balanced powertrain portfolio for the next decade. While electric zero-emission powertrains will dominate in the long run, there is a long transition period during which combustion engine-based powertrains still hold tremendous opportunities. No matter whether the upcoming combustion engine-based powertrain generation is a pure ICE or MHEV powertrain, it is likely to be the last one and could live longer than previous generations.

OEMs will have to make a strategic choice to either focus solely on zero-emission vehicles or to bring advanced 48V combustion engine-based powertrains in addition to electric powertrains into the market. Managing the complexity of the powertrain portfolio should therefore be a key priority of OEMs.

*Powertrains that enable driving a significant distance electrically, i.e., without a combustion engine

About the authors: Representing McKinsey & Company, Andreas Tschiesner is Senior Partner, Patrick Hertzke is Partner, Patrick Schaufuss is Expert Associate Partner and Thomas Gersdorf is Consultant