During the last CES in Las Vegas, Sony Chief Executive Kenichiro Yoshida said, “It’s not an exaggeration to say that mobile has been the mega-trend of the last decade. I believe the next mega-trend will be mobility.”

Based on a global research of investment trends in mobility, published in the Global Mobility Roadbook, PTOLEMUS Consulting Group confirms that this statement is corroborated by actual transactions made by international investors.

The breakthrough year was 2017, when transactions grew by a factor of 5x for micro-mobility; 4x for electrification; 3x for autonomous vehicles; 2.5x for telematics; and 2x for ride hailing.

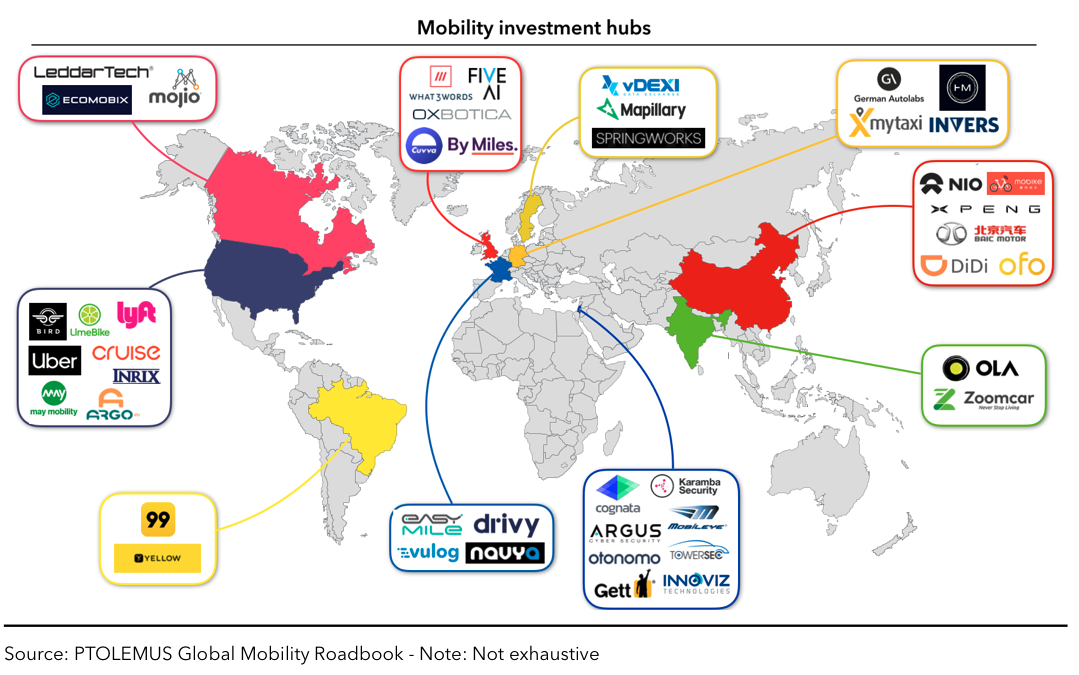

As shown in the accompanying map, investment hubs have been flourishing everywhere.

But Chinese and US firms accounted for more than 70% of these investments! The largest transactions were Uber China acquired by DiDi and Cruise Automation acquired by GM.

So, what are investors looking for in future mobility start-ups?

Thanks to our in-depth analysis of the latest trends in the mobility ecosystem, we identified the five main traits of start-ups that received the bulk of the funds.

1. A unique business model supported by smartphone technologies

Ride-hailing became possible because of the massive adoption of smartphones. Thanks to connectivity, GNSS positioning and payment capabilities, smartphones can track and trace available vehicles; calculate a usage-based trip in real time; and book and pay.

The combination of these factors enabled a unique offering that radically improved on existing taxi services by simplifying the trip request while optimising driver-passenger matching. Many regulatory questions remain open, and in particular, the best interaction model between ride hailing companies and taxis needs to be defined.

Still, it is a fact that everything else being equal, the ride-hailing model reduces the total cost of the service operation by leveraging existing technologies (smartphones, cellular network, satellites, maps, AI, electronic payments network and vehicles). It also reduces one of the biggest problems for taxi drivers: the large amount of the time they spend waiting for customers.

2. A scale-up and monetisation potential

While most ride-hailing companies remain unprofitable, they are rapidly improving their EBITDA thanks to their huge customer base and new monetisation initiatives.

The immense success of Uber and other ride-hailing companies before 2017 increased investors’ interest in the industry.

Ride-hailing quickly seduced investors seeking business models with high growth potential in similar mobility verticals, notably micro-mobility and car-sharing. As mentioned earlier, investments in micro-mobility quintupled.

The new shared business models are also unique and have happened, on top of smartphones, thanks to the democratisation of so-called telematics devices, i.e. connected black boxes used to monitor and unlock vehicles (cars, e-scooters, bikes or mopeds) remotely. Further, most shared vehicles in these business models are battery electric, something that a few years ago was not possible given the costs and stage of technological development.

However, micro-mobility and car-sharing businesses have not grown at the same rate as ride-hailing. The services still face significant hurdles:

- The new owner-free model has come with vandalism, which not only reduces the average lifetime of the vehicle, but also diminishes the quality of service for the users;

- In addition to considerable platform and marketing costs, shared services also required substantial investments in telematics devices and logistics to re-allocate and power the vehicles;

- While ride-hailing proved a better net present value (NPV) for a big group of users compared to its main substitutes, taxis or low usage car ownership, micro-mobility has remained more expensive relative to its alternatives, i.e. walking (free), bus or train (low-cost and subsidised).

All of the above clearly affected the monetisation and growth potential of such services.

3. The integration of multiple services and modes of transport

While it is still difficult to prove the case for single-transport shared mobility, Mobility-as-a-Service (MaaS) platforms are integrating several transport modes, thus creating a successful model for shared mobility by bringing in more users, as Uber is doing with Jump.

The first services are being deployed, starting in Scandinavia and with a footprint that remains within metropolitan areas. Thanks to positive feedback from both customers and cities, current MaaS projects are developing quickly.

However, in the short term, we will see it emerging in a limited number of cities as it requires strong coordination between public and private entities, and interoperability remains its most critical challenge.

After analysing the key mobility platform providers globally, we have learnt that those who have managed to secure investments share some characteristics:

- The ability to spot a gap in the market;

- The ability to adapt fast and work together with diverse organisations;

- A wide range of features, ready to be deployed internationally;

- An open API architecture, enabling their clients to integrate third-party providers for certain services easily (e.g. parking spots, charging stations), numerous transport operators and various types of shared vehicles;

- The willingness to build a standardised system and share their data to create the best solution for end-users;

- The ability to gather and process considerable transit datasets;

- Strong partnerships with major technologies firms.

4. Clear expectations on the time horizon of investment returns

The mass adoption of highly autonomous vehicles will be the long-term driver of future growth for on-demand and shared mobility. It will make ride-hailing, car-sharing, car-pooling and taxis converge into a single on-demand service, which will further reduce the total cost of the service operation.

It will also enable on-demand autonomous shuttles to cover routes that are unprofitable for public transport operators (PTOs). While the uniqueness is evident, its timeline and adoption rate are not. Still, investors who have been betting on this technology for a long time now know that they are investing in the future and that returns will take time. Furthermore, they are aware that such investments offer tremendous collateral monetisation opportunities as they are opening the door to the robotics industry.

5. Business models aligned to future regulations

The demand for mobility services is not only driven by customer preferences.

Governments are playing a crucial role by providing incentives to technologies that improve safety and reduce pollution, now one of the most significant health issues for people living in cities.

In the UK, the comparison between traffic-related fatalities and deaths due to air pollution is shocking. Air pollution, largely caused by road traffic, particularly in Europe and North America (as they have “exported” of their polluting industries to Asia) causes more than ten times more deaths than road traffic incidents.

Environment-led regulations will drive the shift to electrification and will affect not only passenger cars but also other means of transportation, e.g. buses and e-scooters.

Just by including a battery in a vehicle, new usage models can flourish. Users that were not using bicycles before are now switching to them thanks to the convenience of e-bikes. The bicycle industry is living its second birth thanks to electric batteries. And, significantly, because cities have started to build dedicated lanes. Still, the EV charging infrastructure will need to keep up as a larger share of the light vehicle fleet is electrified, a situation that is also pulling resources from investors.

Overall, start-ups that solve an environmental problem will benefit from a considerable upside potential. They will succeed not only in Europe and North America but also in China and India, which have the most acute pollution and congestion challenges.

In a nutshell, in the future mobility ecosystem, investors are looking for start-ups with disruptive customer experiences and business models that leverage technology to provide better mobility services at a lower cost.

At the same time, they are keen to invest in flexible businesses that can scale up internationally, integrate multiple user-centric services and ideally transport modes, thus creating several monetisation opportunities and potential revenue streams.

Finally, they want to understand the time horizon of their investment and make sure that the business opportunity is in line with regulation.

About the author: Alberto Lodieu is a Manager at PTOLEMUS Consulting Group