Fully autonomous cars will become mobile living rooms, allowing car manufacturers to reimagine the future of car interiors. In its fifth annual survey, the Japanese technology company Asahi Kasei asked car users in the four major automotive markets about their expectations and concerns regarding fully autonomous vehicles and their perception of sustainability. Customer preferences for interior design, features, and usage scenarios offer the automotive industry valuable hints about what the car of the future should look like.

The results of Asahi Kasei’s fifth global Automotive Consumer Survey present meaningful information about what customers in the four major automotive markets (Japan, China, Germany, and the United States) expect from autonomous vehicles and how they would spend their time in one.

Distrust in technology

Car users are still conservative regarding the operation of a fully autonomous car; a retractable steering wheel and pedals are not considered valuable to most respondents. This confirms the results of the last survey from 2022, which found that even in fully autonomous vehicles, a large proportion of users in Germany, the USA, and China prefer to have a steering wheel and brake pedal for optional manual control. In Japan, one in two share this outlook. In Germany and the USA, providing a manual control option could help increase acceptance of fully autonomous cars.

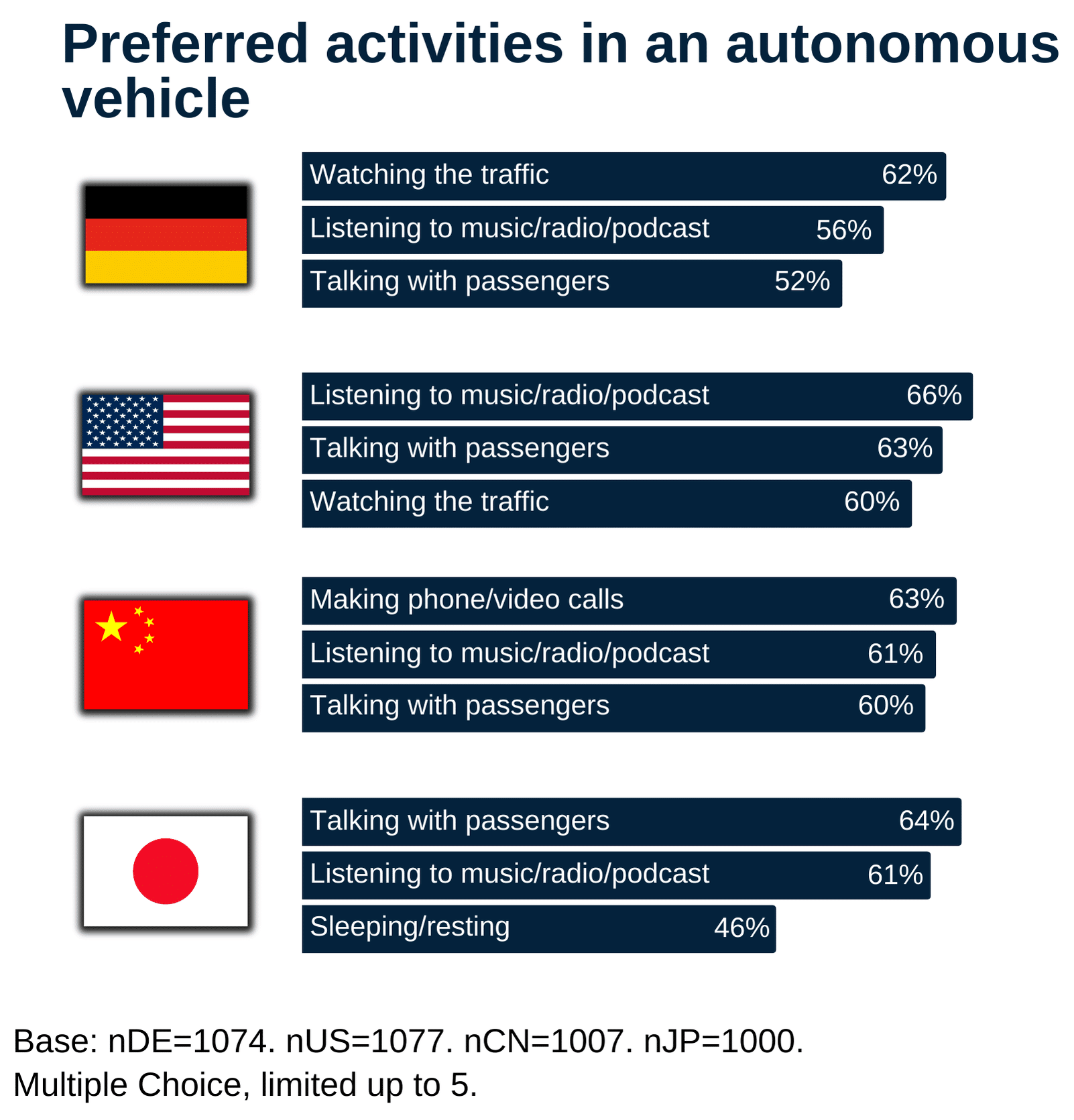

In addition, two out of three car users in Germany, the USA, and China stated they would still observe traffic while in autonomous mode—activities while in the car, such as watching movies or playing games, are at the bottom of the list (see Figure 1). This is another indication that car users today have safety and trust concerns about fully autonomous cars. These sentiments will profoundly define the interior design of the first generations of fully autonomous vehicles.

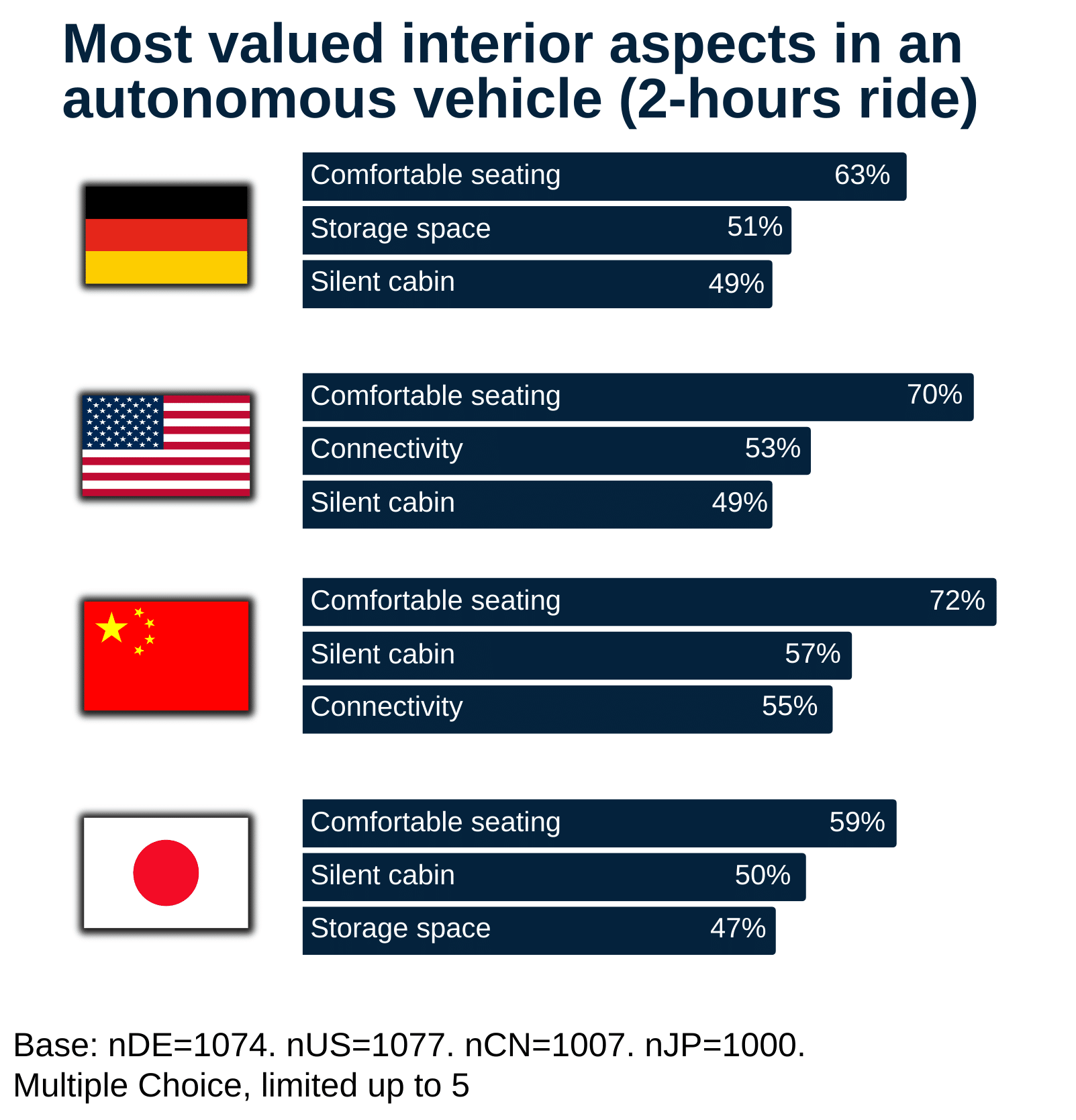

Silent cabin for communication and listening to music

When asked about the most valued interior aspect of an autonomous car, one out of two respondents mentioned “silent cabin” (see Figure 2). This speaks to the woes of many battery electric vehicle (BEV) users; almost every fourth user of a BEV mentioned “too much noise while driving” as the most annoying aspect of the driving experience. While the BEV itself is quieter than a car with an internal combustion engine (ICE), the noise of wind, tires, gears, and motors—sounds that are typically suppressed by the engine noise—becomes more prevalent. In fully autonomous electric vehicles, and with the ability to engage with other activities while commuting, silence will even become more important for customers.

Looking at activities while riding in an autonomous vehicle, listening to music and podcasts is the primary activity of car users worldwide while driving, with 66% in the USA, 61% each in China and Japan, and 56% in Germany. Talking with other passengers is equally high in ranking, with sleeping or working as less important, highlighting the need for tables or lie-flat seats.

Perception of sustainability differs among regions

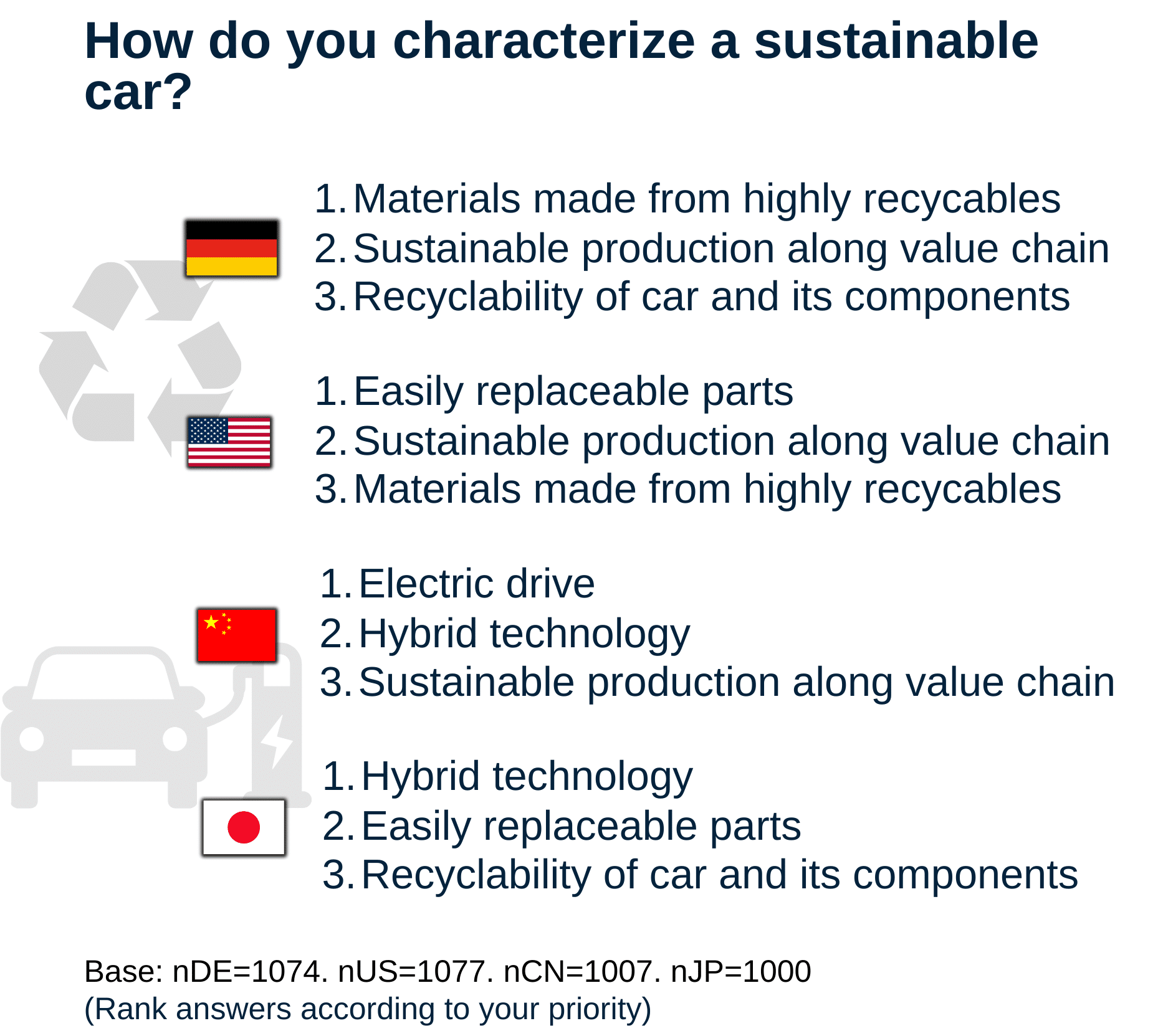

Car users no longer define a “sustainable vehicle” only by its drivetrain technology but also by its carbon footprint in production, easily recyclable materials, and overall sustainable production along the entire value chain. Buyers’ understanding of sustainability is growing, and the relevance of this topic in the purchasing process has increased in recent years.

Respondents in the Western markets define a sustainable car by its use of recyclable materials and sustainable production along the value chain. Meanwhile, for car users in China and Japan, the drivetrain technology primarily defines a sustainable car (see Figure 3). This topic is becoming more relevant for the purchase decision process, particularly in Western countries, with 35% of all respondents in Germany and the USA indicating they would switch their car brand to a more sustainable manufacturer to support greener mobility.

SOURCE: Asahi Kasei