Ford showed focus, speed and accountability in producing solid second-quarter 2023 operating results, while taking strategic actions that are expected to help create a high-performing business and long-term value for all stakeholders.

“The shift to powerful digital experiences and breakthrough EVs is underway and going to be volatile, so being able to guide customers through and adapt to the pace of adoption are big advantages for us,” said Ford CEO Jim Farley. “Ford+ is making us more resilient, efficient and profitable, which you can see in Ford Pro’s breakout second-quarter revenue improvement (22%) and EBIT margin (15%).”

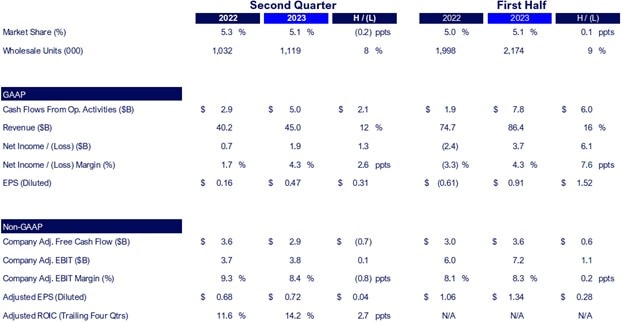

Company Key Metrics Summary

Ford was again America’s top-selling brand in the quarter – net sales increased more than 11% – and for the first six months of 2023. Worldwide, demand for Ford’s fresh lineup of trucks, SUVs and commercial vans pushed second-quarter revenue up 12%, to $45 billion. Quarterly net income was $1.9 billion, nearly three times higher than in the year-ago period and a 4% margin. Adjusted earnings before interest and taxes, or EBIT, grew to $3.8 billion or 8.4% of revenue.

Cash flow from operations and adjusted free cash flow continued to be strong, at $5.0 billion and $2.9 billion, respectively. So was Ford’s balance sheet, with nearly $30 billion of cash and more than $47 billion of liquidity at the end of Q2, both of them up sequentially and year-over-year.

CFO John Lawler reiterated that the company has ample resources to simultaneously fund disciplined investment in growth and return capital to shareholders – for the latter, targeting 40% to 50% of adjusted free cash flow. On July 13, Ford’s board of directors declared the latest regular dividend of 15 cents per share, payable Sept. 1 to shareholders of record at the close of business on July 25.

Business Segment Highlights

In the second quarter, Ford Pro – with a winning combination of vehicles, software and services that generates value for commercial customers and pricing power for Ford – turned 8% growth in product shipments into a 22% jump in revenue. The business unit’s $2.4 billion in EBIT was more than twice its profitability a year ago and represented a 15% margin.

Customer deliveries of the all-new Super Duty work truck had an immediate effect on Ford Pro’s performance, with quarterly U.S. sales of Super Duty up 28%. Global revenue from both gas-powered Transit and electric E-Transit commercial vans was also up.

Commercial customers are also beneficiaries of Ford’s digital innovation and rapidly expanding software and services. Ford Pro accounts for more than 80% of the company’s nearly 550,000 paid software and services subscribers, to date, including solutions for fleet management, telematics and EV charging.

Ford Blue – which engineers, makes and sells highly popular gas and hybrid vehicles, including specialized derivative models – improved its performance in every region.

The appeal and pricing power of Ford Blue’s iconic products helped account for growth in wholesales and revenue, and $2.3 billion in EBIT. Segment initiatives to improve quality and reduce costs are expected to further raise its effectiveness and profitability over time.

In May, Ford Blue and Ford Pro together launched the fully redesigned, highly connected 2024 Ford Ranger. Ranger is a vital part of Ford’s global pickup leadership and is sold in more than 180 markets.

Revenue from Ford Model e’s first-generation electric vehicles increased 39% in the second quarter; sequentially, revenue more doubled.

“The near-term pace of EV adoption will be a little slower than expected, which is going to benefit early movers like Ford,” Farley said. “EV customers are brand loyal and we’re winning lots of them with our high-volume, first-generation products; we’re making smart investments in capabilities and capacity around the world; and, while others are trying to catch up, we have clean-sheet, next-generation products in advanced development that will blow people away.”

Farley said that Ford now expects to reach a 600,000-unit EV production run rate during 2024 and will maintain flexibility, balancing growth and profitability, on the way to attaining a two-million run rate.

Last week, citing increasing production capacity at the Rouge Electric Vehicle Center in Michigan, continued work on cost scaling and improving prices for EV battery raw materials, Ford announced lower suggested retail prices for the all-electric F-150 Lightning pickup truck.

In April, Ford Model e announced a plan to transform Ford’s existing complex in Oakville, Ont., Canada for high-volume EV manufacturing – assembling battery packs and installing them in next-generation electric vehicles produced on the same campus.

Also during the second quarter, the company:

- Opened the Ford Cologne Electrification Center in Germany, its first carbon-neutral factory and home of the forthcoming, all-new Ford Explorer for Europe

- Completed capacity expansion for the Mustang Mach-E in Cuautitlan, Mexico, and initiated another enlargement of the Rouge facility

- Made substantial progress on construction of a next-generation EV pickup plant in West Tennessee, and three joint-venture battery manufacturing facilities in Tennessee and Kentucky, and

- Started site preparation for a wholly-owned plant in Michigan that will produce lithium iron phosphate, or LFP, EV batteries.

The in-company Ford Model e startup is also responsible for advanced digital platforms and software across all Ford product lines. A primary example is the BlueCruise Level 2 advanced driver-assistance system, which through the first half of 2023 had enabled more than 1.4 million hours of hands-free driving for customers across North America.

Ford Credit generated earnings before taxes of $390 million, down from a year ago, as expected, reflecting lower financing margin, the nonrecurrence of credit losses reserve releases and a decline in residual values of leased vehicles – all of which were anticipated in the company’s full-year outlook.

Lawler said the Ford+ plan is designed to turn great value for customers into the same for shareholders and other stakeholders by “breaking Ford out of the cycle of low margins and high capital that’s typified traditional automakers for way too long.”

“We’ve got big ambitions, our approach is different from anyone else’s and we’re doubling down where we have competitive advantages – in trucks, SUVs and commercial vans,” he said. “We think doing that, raising quality and lowering costs can earn us the kind of profitable growth and valuation that best-in-class, technology-led industrial companies command.”

Outlook

Ford is lifting its guidance range for full-year 2023 consolidated adjusted EBIT to between

$11 billion and $12 billion. Likewise, the company is raising its expectations for full-year adjusted free cash flow to between $6.5 billion and $7 billion, with capital expenditures of between $8 billion and $9 billion.

The guidance presumes:

- Headwinds including global economic uncertainty and inflationary pressures, higher industrywide customer incentives and continued EV pricing pressure, increased warranty costs, lower past service pension income, exchange rates and costs associated with union contract negotiations, along with

- Tailwinds comprising an improved supply chain, higher industry volumes, upside from the all-new Super Duty and lower commodity costs.

For its transparent, customer-centered business units, Ford now expects full-year EBIT:

- Approaching $8 billion for Ford Pro, more than double in 2022, from significant year-over-year improvement in pricing and volume

- Of about $8 billion from Ford Blue, with higher volumes and stronger mix more than offsetting any potential pricing headwinds, and

- To be a loss of about $4.5 billion for Ford Model e, reflecting the pricing environment, disciplined investments in new products and capacity, and other costs.

Full-year EBT for Ford Credit is anticipated to be about $1.3 billion.

The company plans to report third-quarter 2023 financial results on Thursday, Oct. 26.

SOURCE: Ford