- 2023 9-months:

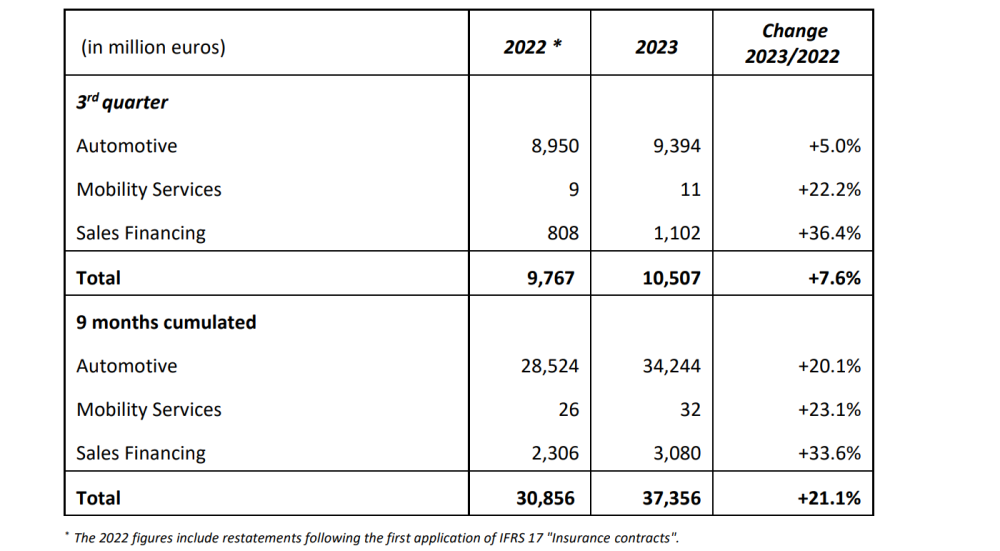

- Group revenue at €37.4 billion, +21.1% vs 2022 9m1, +25.3% at constant exchange rates2

- Auto revenue at €34.2 billion, +20.1% vs 2022 9m1, +24.2% at constant exchange rates2

- Group registrations up 10.9% globally and 21.3% in Europe

- 2023 Q3:

- Group revenue at €10.5 billion, +7.6% vs 2022 Q31, +13.8% at constant exchange rates2

- Auto revenue at €9.4 billion, +5.0% vs 2022 Q31, +11.3% at constant exchange rates2

- Group registrations up 6.1% globally and 15.3% in Europe

- Continued strong price effect at 7.5 points over the quarter

- Europe orderbook remains very healthy at 2.5 months of forward sales at the end of September

- 2023 guidance confirmed:

- a Group operating margin between 7% and 8%

- a free cash flow superior or equal to €2.5 billion

Renault Group expects a Group operating margin in H2 above H1, which was at 7.6%.

“Renault Group achieved again a strong performance in the third quarter with total revenue increasing by 13.8% at constant exchange rates. We have entered the last quarter with confidence and confirm the improvement of our profitability in the second half of the year and beyond, driven by our product offensive, along with the benefits of our cost reduction program and our disciplined commercial policy focused on value.

In the meantime, we are moving fast forward on all our Revolution projects and this quarter was very active. We officially launched Horse and signed the JV agreement with Geely. Ampere carve-out will occur in November and we will present in detail its strategy during a Capital Markets Day on November 15th. We also announced the Flexis Project together with Volvo Group and CMA CGM, a true game changer to tackle the challenges of electrifying LCVs in the urban logistics sector. We are progressively building our next-gen automotive company.

Finally, following the signature of the Alliance definitive agreements in July, we confirm that the completion of the transaction is expected by the end of the year, as planned. This will create additional value through common operational projects and give Renault Group the opportunity to optimally reallocate part of its capital.” said Thierry Piéton, Chief Financial Officer of Renault Group.

- Revolution projects – latest developments:

- Horse (dedicated entity for advanced low-emission ICE and hybrid powertrains):

- Carve-out effective on July 1st, 2023.

- Signing of a JV binding agreement on July 11th, 2023 with Geely, enabling the deconsolidation of Horse and the start of the new JV upon closing.

- Ongoing discussions with Aramco.

- Ampere:

- Carve-out effective in November 2023.

- Capital Markets Day on November 15th, 2023.

- Targeting the best window for an IPO, most probably in 2024 H1.

- Flexis project:

- Binding agreements signed by Renault Group and Volvo Group to launch a new company (initial 50-50 equity stakes) to pioneer and lead the e-LCV European market with an all-new generation of fully electric vans.

- CMA CGM Group would join the new company.

- Expected closing of the new company early 2024.

- Alliance:

- Definitive agreements signed in July 2023. Completion of the transaction expected in Q4, as planned. Once finalized, Renault Group will be able to monetize the 28.4% of Nissan shares transferred to a trust.

- Horse (dedicated entity for advanced low-emission ICE and hybrid powertrains):

1 The 2022 figures include restatements following the first application of IFRS 17 “Insurance contracts”.

2 In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

Commercial results: Third quarter highlights

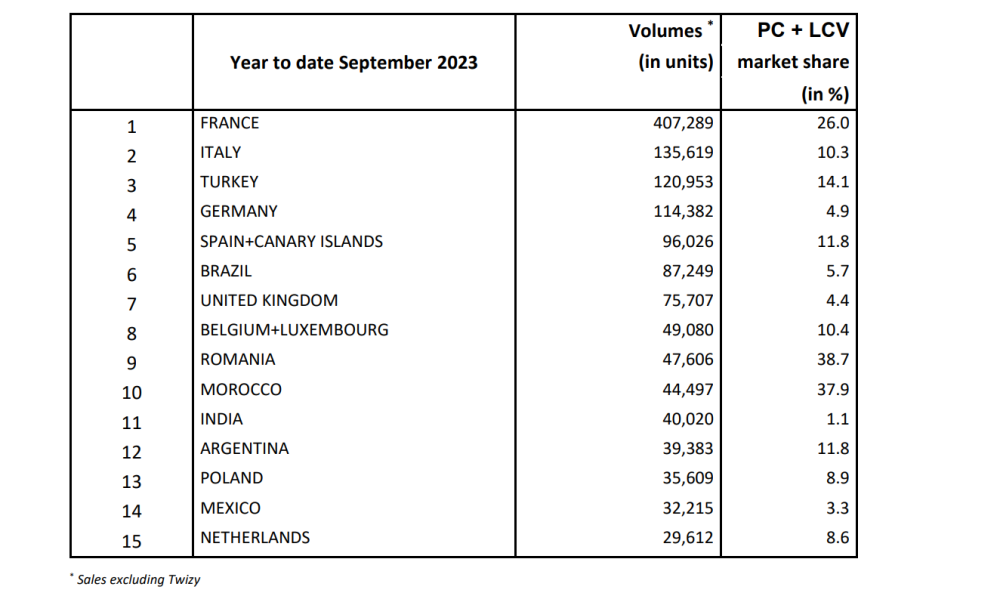

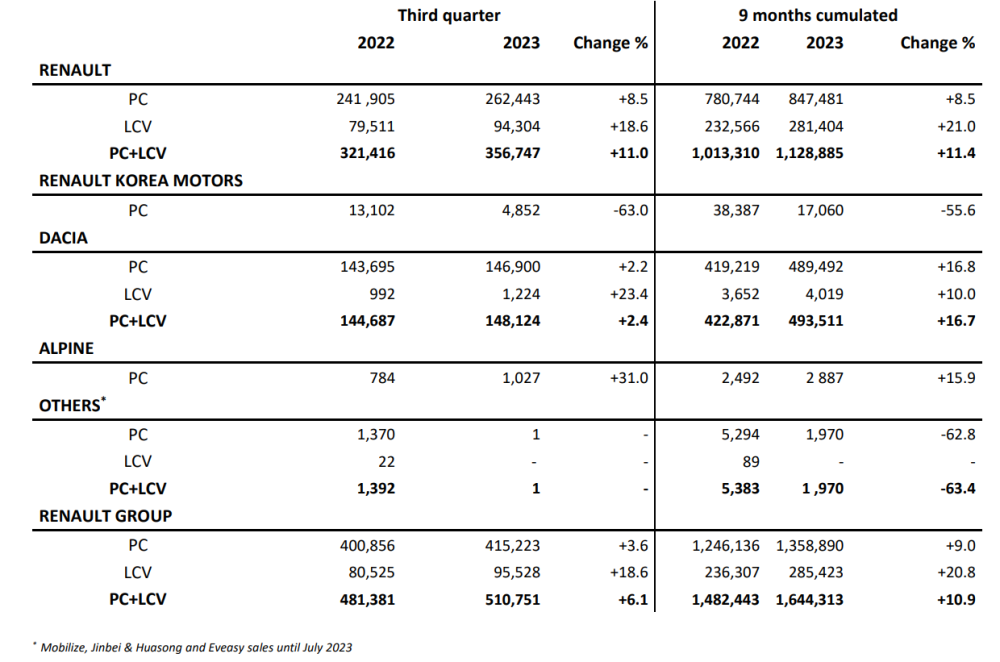

Worldwide Group’s sales reached 511,000 vehicles in 2023 Q3, up 6.1% compared to 2022 Q3. In Europe, sales were up 15.3%.

- Renault brand global sales reached nearly 357,000 units, up 11.0% versus 2022 Q3. In Europe, Renault brand increased its sales by 24.8% to 223,000 units.

- In the first nine months of 2023, Renault brand solidifies its position as the second best-selling automotive brand in Europe, up 22.2% vs. 2022 and reaffirms its leadership in the French market both on the PC market and on the LCV market.

- Renault continues to outperform on the LCV market with 21.0% growth worldwide on the 9 months and especially in Europe up 25.5%. Renault is the European leader on the commercial vans market.

- Dacia recorded 494,000 units worldwide up 16.7% over the first 9 months 2023. In 2023 Q3, Dacia sold 148,000 units globally, up 2.4% versus 2022 Q3.

- The 4 flagships of the Dacia posted increased sales over the first 9 months 2023: Spring +40.6%, Sandero +18.3%, Duster +4.1% and Jogger +76.1%.

- In the retail channel, Dacia maintains its 2nd place on the European podium3 year-to-date.

- Alpine recorded over 1,000 sales in 2023 Q3, up 31.0% versus 2022 Q3.

Continued high price effect at 7.5 points over the quarter:

- Focus on retail with 64% of Group sales on retail channel in the Group’s five main countries in Europe4.

- Renault brand passenger cars sales in C & above segments in Europe increased by 27% in 2023 Q3 versus 2022 Q3.

- Renault Megane E-TECH Electric recorded 11,500 sales in total in 2023 Q3. In the first 9 months, 70% of sales were on high trim versions and 80% on the most powerful engine. It represented 2.2% of the BEV market in Europe.

- Renault Austral recorded close to 21,000 sales in 2023 Q3. In the first 9 months, 65% of sales were hybrid and 60% of high trim versions.

- Renault Espace, launched in June 2023, has broadened the offer and recorded nearly 2,400 sales. It will progressively hit new markets.

Renault Group pursues its electrification offensive:

- Renault brand recorded a 22% volume increase in electrified passenger5 car sales in 2023 Q3 versus 2022 Q3, accounting for 43% of the brand’s passenger car sales in Europe. Full electric vehicles represented 11% of the brand’s passenger car sales in Europe in 2023 Q3.

- This momentum will continue to be supported by Espace E‑Tech Hybrid and the arrival of New Clio with a hybrid engine at the core of its range. From 2024 onwards, Renault’s electric line‑up will further accelerate the dynamic, with Scenic E-Tech and Renault 5 in particular.

- Dacia Jogger Hybrid 140 represents 1 out of 4 of Jogger orders. Jogger is a key product to attract new customer profiles and its hybrid version supports Dacia smooth electrification strategy.

- Dacia Spring (100% electric) recorded close to 16,000 sales in Europe in 2023 Q3. It was again on the podium of retail electric vehicles in Europe being the most affordable BEV on the market.

Third quarter revenue

Group revenue for 2023 Q3 amounted to €10.5 billion, up 7.6% compared to 2022 Q3.

At constant exchange rates6, Group revenue was up 13.8%.

Automotive revenue reached €9.4 billion, up 5.0% compared to 2022 Q3, or +11.3% at constant exchange rates. The negative exchange rates effect of -6.3 points is mostly linked to the Argentinean peso devaluation and to a lesser extent to the Turkish lira.

The rest of the variation is explained by the following:

- A volume effect of -1.6 points. The 6% growth in registrations was offset by higher destocking in the independent dealers’ network in 2023 Q3 compared to 2022 Q3 and coming back to normal seasonal evolutions.

- A geographic mix of +3.1 points benefiting from a higher mix of European sales.

- A still strong price effect of +7.5 points, reflecting the continuation of the commercial policy focused on value, price increases to offset currency effect along with an optimization of commercial discounts.

- A muted product mix effect (-0,4 points), mainly resulting from a very strong end of life of Clio phase 1 with a lower revenue per unit than Renault Group’s average and a lower level of Megane E-tech invoices this quarter in line with destocking, which offset the positive impact of Austral and Espace.

- A positive impact of sales to partners of +2.9 points, mainly supported by a dynamic LCV market driving sales to Nissan, Renault Trucks and Mercedes-Benz as well as from the production of the ASX for Mitsubishi Motors.

- An “Other” effect of -0.2 points. The decrease in the contribution of sales from the Renault Retail Group network following the disposals of branches was partially offset by the performance of parts and services.

Mobility Services contributed €11 million to 2023 Q3 revenue compared to €9 million in 2022 Q3.

Mobilize Financial Services posted revenue of €1,102 million in 2023 Q3, up 36.4% compared to 2022 Q3 due to higher interest rates and to the increase of new contracts coupled with higher average amount financed per unit.

Average performing assets (€52.1 billion) increased by 15.6% compared to 2022 Q3. This is supported by vehicle restocking in the dealerships and by a 15.9% increase in new financing for the retail business.

As at September 30, 2023, total inventories (including the independent network) decreased to 542,000 vehicles with:

- Group inventories at 226,000 vehicles

- Independent dealers’ inventories at 316,000 vehicles

The decrease compared to 569,000 units at the end of June 2023 is in line with the objective of being below 500,000 vehicles at the end of the year.

The level of inventories is in line with the orderbook which remains at 2.5 months of forward sales at the end of September.

2023 FY financial outlook

Renault Group confirms its 2023 FY financial outlook with:

- a Group operating margin between 7% and 8%

- a free cash flow superior or equal to €2.5 billion

Renault Group expects a Group operating margin in H2 above H1, which was at 7.6%.

Renault Group’s consolidated revenue

Renault Group’s top 15 markets at the end of September 2023

Total Renault Group PC + LCV sales by brand

1 The 2022 figures include restatements following the first application of IFRS 17 “Insurance contracts”.

2 In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

3 Retail private vehicles in Europe = Austria, Belgium, Croatia, Czech Republic, Denmark, Finland, France, Germany, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

4 Passenger cars in France, Germany, Spain, Italy, United Kingdom.

5 Includes EV, Hybrid (HEV) and Plug-In Hybrid (PHEV), excludes Mid-Hybrid (MHEV).

6 In order to analyze the change in consolidated revenue at constant exchange rates, Renault Group recalculates revenue for the current financial year by applying the average exchange rates of the previous period.

SOURCE: Renault Group