Rivian Automotive, Inc. today announced its third quarter 2024 financial results. In the third quarter the company produced 13,157 vehicles at its manufacturing facility in Normal, Illinois and delivered 10,018 vehicles during the same period.

The company remains on track for positive gross profit for the fourth quarter of 2024. This is expected to be driven primarily by improvements in revenue per unit, variable cost per unit, and fixed and semi-fixed costs per unit. The increase in revenue per unit is primarily due to an increase in the sale of regulatory credits and increased R1 average selling prices from an improvement in mix towards more premium variants. The variable and fixed / semi-fixed cost improvements are driven primarily by improvements in material cost and operational efficiencies in the production of R1 second generation vehicles.

Rivian has continued to make rapid progress in the design, development, sourcing, and manufacturing facility expansion in Normal, which are critical steps toward achieving our target of launching R2 in the first half of 2026. R2 has been designed to maximize cost efficiency and manufacturability while still delivering on the performance and utility consumers expect from a Rivian. Eighty five percent of the bill of materials has been sourced within Rivian’s cost targets.

RJ Scaringe, Rivian Founder and CEO, said:

“This quarter we have made progress against our key objectives and have seen meaningful progress on our Gen 2 R1 cost structure due to the new technologies incorporated into the vehicle and manufacturing process. We are excited about the future and our midsize SUV, R2, which we believe will be a fundamental driver of Rivian’s growth. We’re also looking forward to closing our proposed joint venture with Volkswagen Group which is expected in the fourth quarter.”

Today Rivian is announcing a strategic supply agreement with LG Energy Solution (LGES) to power its next-generation midsize electric vehicle platform, underpinning the company’s R2 midsize SUV. Under the terms of the agreement, LGES will supply 4695 cylindrical battery cells to Rivian for its midsize platform. Within the first year of production, the batteries are expected to be manufactured at LGES’ Queen Creek, Arizona plant, aligning with Rivian’s focus on U.S. domestic manufacturing and IRA compliance.

This quarter Rivian introduced its second generation Tri-Motor R1 configuration, combining performance levels that surpass the company’s original Quad-Motor offerings. Tri-Motor packs two in-house Ascent motors in the rear and one Enduro motor in front for a blend of exceptional power and range. With 850 horsepower and 1,103 Ib-ft of torque, it reaches 0-60 mph in 2.9 seconds.

In August the company introduced Connect+, a streaming and connectivity service for Rivian owners. Connect+ is a paid subscription that offers seamless access to enhanced connectivity features and a host of new apps in Rivian’s consumer vehicles. Because of Rivian’s fully integrated software platform, Connect+ shows streaming services natively within the vehicle’s display, making for a simple, convenient and immersive infotainment experience. Following the launch of Connect+, Rivian provided customers a 60 day free trial period and has seen the majority of customers subscribe to Connect+ following the free trial period.

As previously disclosed on October 4, the company is experiencing a production disruption due to a shortage of a shared component within its Enduro motor system on the R1 and RCV platforms. As a result of this disruption Rivian revised its latest full year 2024 production guidance to between 47,000 to 49,000 vehicles, and is also revising its annual adjusted EBITDA guidance to between a $(2.825) billion loss to a $(2.875) billion loss. Rivian is reaffirming its delivery outlook of between 50,500 to 52,000 vehicles and $1,200 million in capital expenditures.

Rivian believes the formation of the joint venture is a landmark development for the industry. The joint venture will benefit from Rivian’s differentiated and well-proven zonal network architecture and full-stack software technologies, enhanced software and electrical architecture innovation. The joint venture validates Rivian’s technology leadership and creates new growth opportunities for Rivian to be a technology partner to other manufacturers.

Financial Highlights:

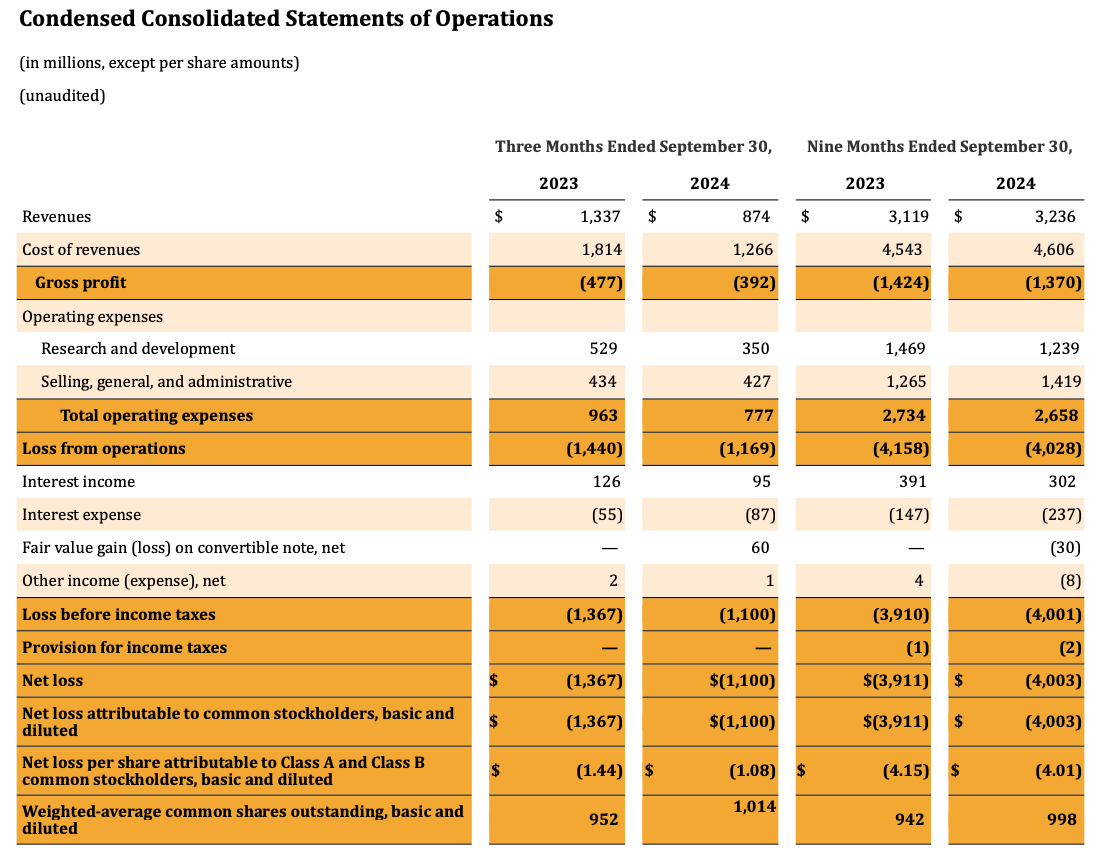

Revenues:

Total revenues for the third quarter of 2024 were $874 million, primarily driven by the delivery of 10,018 vehicles. Total revenues from the sale of regulatory credits were $8 million for the quarter.

Gross Profit:

Rivian generated negative gross profit of $(392) million for the third quarter of 2024 as compared to $(477) million for the third quarter of 2023.

Cost of revenues for the third quarter of 2024 included $37 million of costs the company does not anticipate being part of its long-term cost structure which was made up of cost of revenue efficiency initiatives primarily related to certain supplier liabilities incurred.

Operating Expenses and Operating Loss:

Total operating expenses in the third quarter of 2024decreased to $777 million, as compared to $963 million in the same period last year.

In the third quarter of 2024, the company recognized a non-cash, stock-based compensation expense within operating expenses of $105 million as compared to $219 million in the third quarter of 2023 and depreciation and amortization expense within operating expenses of $73 million as compared to $80 million in the third quarter of 2023.

Net Loss:

Rivian’s net loss for the third quarter of 2024 was $(1,100) million as compared to $(1,367) million for the same period last year.

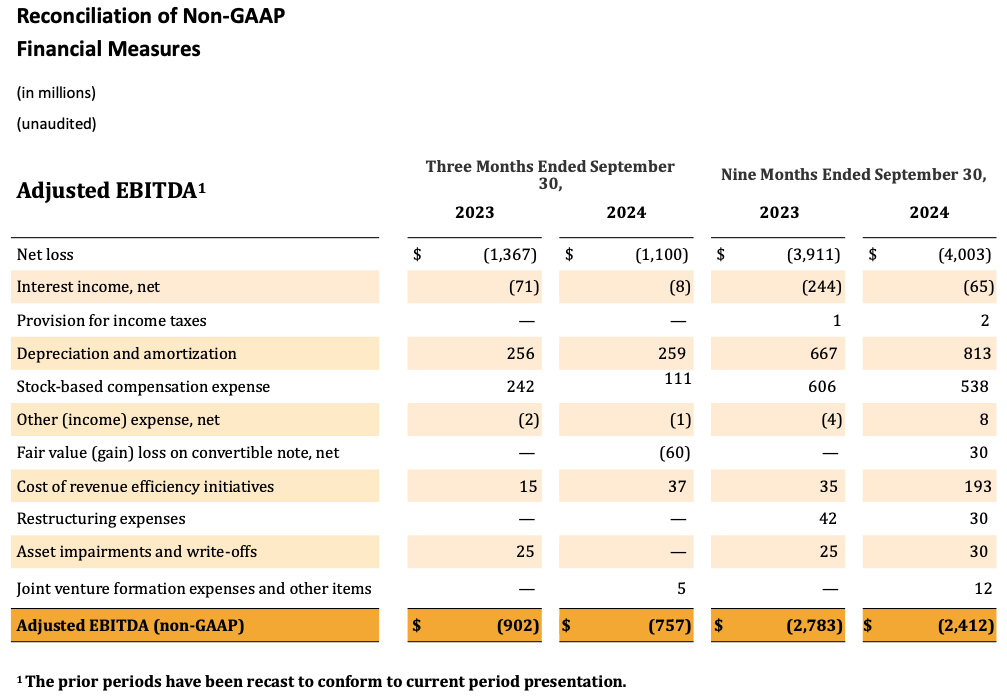

Adjusted EBITDA (non-GAAP)*

Adjusted EBITDA* for the third quarter of 2024 was $(757) million as compared to $(902) million for the same period last year.

Capital Expenditures:

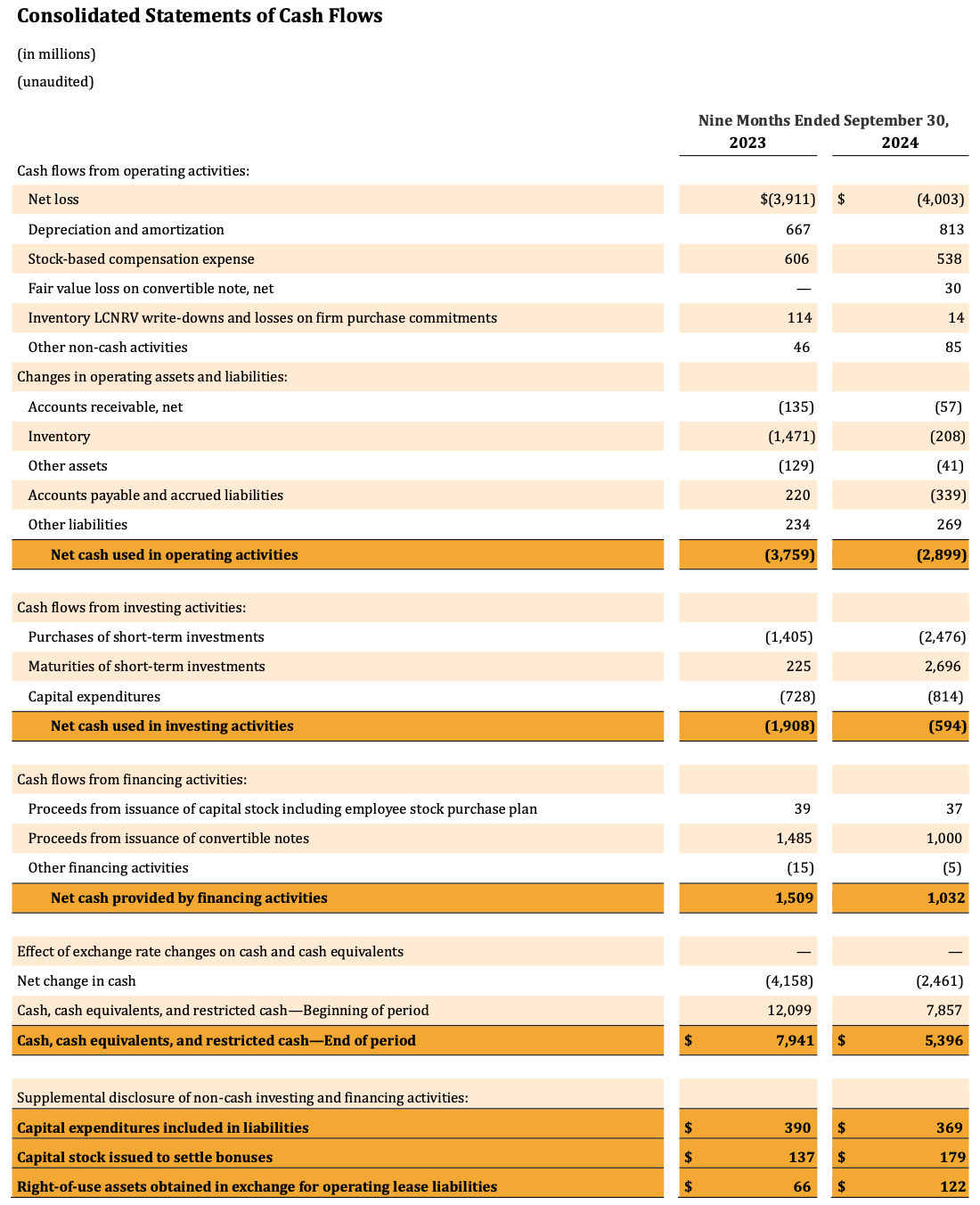

Capital expenditures for the third quarter of 2024 were $277 million, as compared to $190 million for the same period last year.

Liquidity:

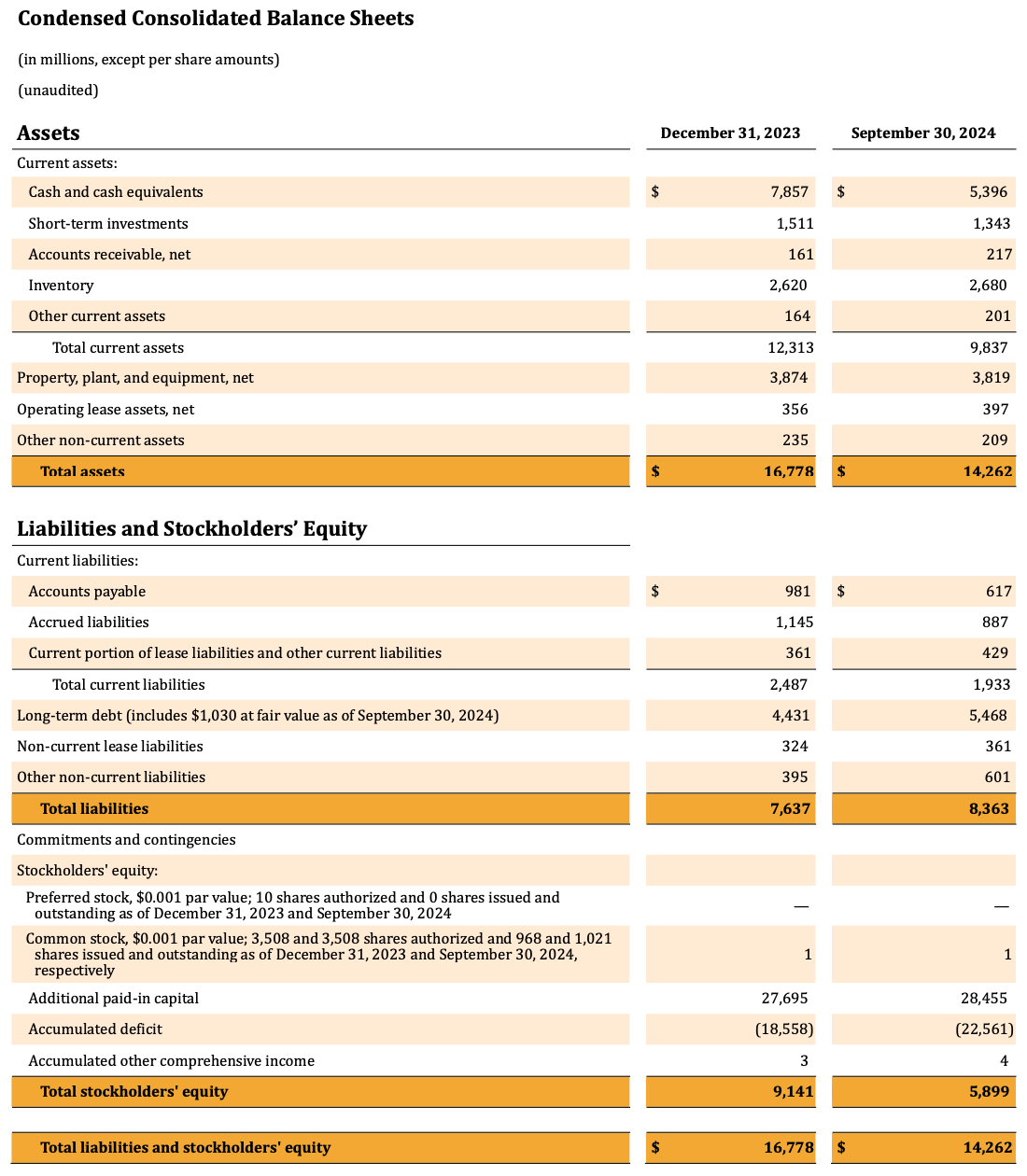

Rivian ended the third quarter of 2024 with $6,739 million in cash, cash equivalents, and short-term investments. Including the capacity under its asset-based revolving-credit facility, the company ended the third quarter of 2024 with $8,105 million of total liquidity.

The third quarter of 2024’s ending cash, cash equivalents, and short-term investments balance of $6,739 million includes $1 billion of an unsecured convertible note issued to Volkswagen International America, Inc. in association with the announcement of our expected joint venture with Volkswagen Group. The convertible note will automatically convert into shares of Class A common stock on December 1, 2024 as all conversion conditions have been satisfied as of September 30, 2024.

SOURCE: Rivian