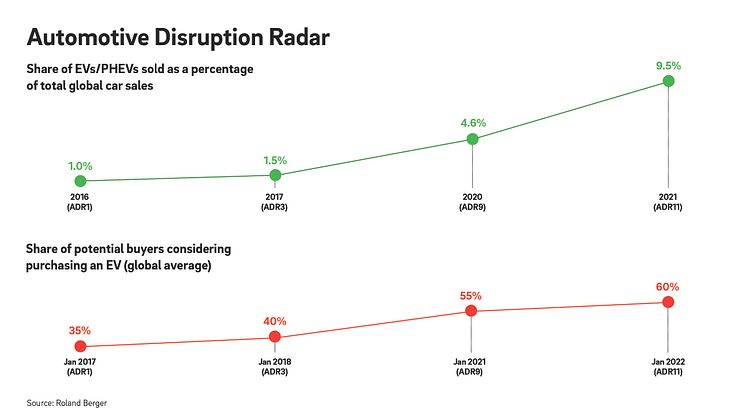

Electric mobility is booming in spite of the difficult economic situation and tight global supply chains. As a share of global new car sales, electric vehicles and plug-in hybrids rose from 4.6% (2020) to 9.5% (2021). The trend shows no sign of slowing, with 60% of potential car buyers around the world already considering an electric vehicle as their next car. These are among the key findings of Roland Berger’s latest Automotive Disruption Radar (ADR), a twice-yearly study of 26 automotive indicators in 23 countries.

“Innovations like autonomous driving and electric mobility must be pushed if we are going to reduce global carbon emissions,” says Wolfgang Bernhart, Partner at Roland Berger. “Even though many countries have made progress, we are only just beginning to reach an inflection point for modern mobility. The task now is to take existing technologies to the next level. The automotive industry should take this challenge as an opportunity to build competitiveness for the future. The customer demand is there. Automakers that act fast can power ahead of their competition.”

China back on top

After a two-year gap, China tops the ADR ranking once again. Reasons include the fact that, as a leading country in the electric vehicle industry, it is more open to new driving technologies. Added to that, almost 500 million Chinese now have access to a 5G mobile network, a must-have for autonomous vehicles. The inflection point has arrived in China, with the 5G standard overtaking 4G.

The Netherlands placed second in the ranking, partly because of the government’s very early decision to ban the sale of combustion engine vehicles from 2030. Third is Singapore, followed by Norway and Sweden in joint fourth place. South Korea came in sixth, with Germany and the UK sharing seventh spot. Germany passed a law in May 2022 permitting vehicles with Level 4 autonomous driving capability (no human interaction needed) to be driven on public roads. This currently counts as the most progressive national legislation on autonomous driving.

Strong interest in electric vehicles leads to rising sales figures

Global supply is higher than ever, with 550 different electric vehicle (EV) and plug-in hybrid (PHEV) models, and customer demand is growing. China takes pole position in absolute numbers, with almost 3.4 million EVs and PHEVs sold. Germany is in second place, with 691,000 electric vehicles sold. In terms of the market penetration of EV/PHEV/FCEVs, Norway (76.4%), Sweden (41.2%) and the Netherlands (25.2%) lead the field.

Traditional OEMs risk falling behind

The survey reveals that new, specialized manufacturers that produce electric vehicles only and are thus able to position themselves as zero emission companies have a significant advantage against traditional OEMs. Only 12% of respondents said they would stick with the traditional OEMs when buying an electric car. Conversely, more than three times as many (38%) said they would only buy an electric vehicle from one of the new electric-only automakers.

“If the incumbent OEMs do not adapt fast to the new conditions on the market and redesign their business model from both a financial and a technological standpoint, they will find themselves overtaken by the competition,” states Stefan Riederle, Partner at Roland Berger.

SOURCE: Roland Berger