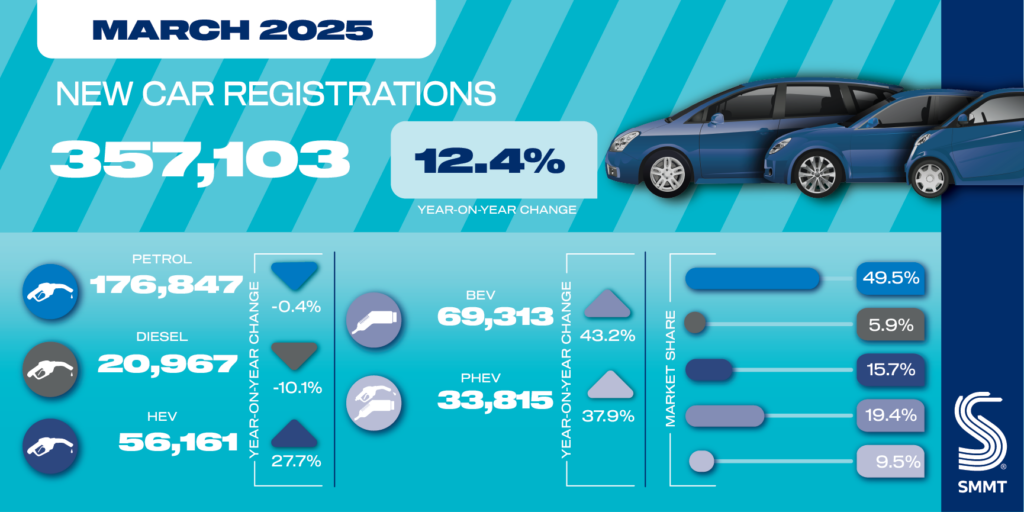

The new car market benefitted from a 12.4% boost in March as uptake rose to 357,103 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). This growth, in the most important month of the year for the new car market, builds on the March 2024 performance, where uptake rose by 10.4%. As a result, this year’s ‘new plate’ month represents the best March performance since 2019.1

Fleet registrations rose 11.5%, while business buyers decreased by a marginal -0.3%. There was also a recovery in private buyer uptake following last year’s lacklustre performance, with a 14.5% rise in registrations.

All types of electrified vehicles recorded growth in the month, with hybrid electric vehicles (HEVs) up 27.7%, plug-in hybrids (PHEVs) up 37.9%, and battery electric vehicles (BEVs) up a massive 43.2% as manufacturers incentivised uptake with significant discounting.2 As a result, March became the largest month ever for registrations of electric cars. Some 69,313 new cars reached the road as manufacturers sought to deliver ever more zero emission vehicles to drivers during the new ‘25 plate’ month, which usually accounts for around 16% of annual registrations and, as such, provides a strong indicator of likely overall annual performance.

While EV market share improved significantly on March 2024, at 19.4% it remains more than eight percentage points behind targets set by the ZEV Mandate. Furthermore, given the VED Expensive Car Supplement can now apply to eligible new EVs from 1 April – potentially raising ownership costs for most EV drivers by more than £2,000 over the next six years – the March EV performance will have been boosted by shrewd buyers seeking to get ahead of the taxation increase3. This underscores the challenge facing manufacturers whose 2025 EV sales must accelerate to 28% share over the course of the year.

Manufacturers continue to incentivise EVs, incentives that cost the industry some £4.5 billion last year. Investment in product development is also bringing ever greater choice to consumers, with more than 130 EV models now available across every size category, and average range now reaching above 290 miles – more than double the average weekly mileage.4 Year to date, however, BEV uptake comprises 20.7% of the market, highlighting the importance of government incentives and mandatory targets for chargepoint rollout to reassure consumers and stimulate EV demand.

In this regard, last week’s Spring Statement was a missed opportunity to intervene, as government incentives can change consumer behaviour. An SMMT survey in February 2025 found that fewer than one in four new car buyers intend to buy an electric car by 2028 but two in five electric sceptics could be convinced to switch if government incentives were available, as is the case in most other European markets.5 In the absence of such consumer support, and with September and the introduction of the 75-plate the next major opportunity to drive EV volume uptake significantly, rapid reform of the regulation is essential – else the industry will face compliance costs that will undermine the viability of their UK operations.

Mike Hawes, SMMT Chief Executive, said, “A welcome return to growth, and substantial growth at that, is a fillip for the industry. Moreover, with March being the best month ever for electric car registrations, there is reason for optimism. Manufacturers remain committed to the market decarbonisation the country and the environment demands, but we need sustained growth, not a short-term bubble driven by unsustainable manufacturer discounting and drivers rushing to beat a tax hike. Without substantive government support for consumers, the current regulatory regime is undeliverable. A rapid response to the government consultation is therefore needed – one that adds flexibilities that reflect the natural level of demand and supports the industry to deliver growth in the face of a tough set of global challenges.”

| MARCH | % Change | YEAR-TO-DATE | % Change | |||||||

| MARQUE | 2025 | % Market share | 2024 | % Market share | 2025 | % Market share | 2024 | % Market share | ||

| Abarth | 89 | 0.02 | 153 | 0.05 | -41.83 | 134 | 0.02 | 282 | 0.05 | -52.48 |

| Alfa Romeo | 616 | 0.17 | 196 | 0.06 | 214.29 | 741 | 0.13 | 329 | 0.06 | 125.23 |

| Alpine | 26 | 0.01 | 90 | 0.03 | -71.11 | 42 | 0.01 | 150 | 0.03 | -72.00 |

| Audi | 17,513 | 4.90 | 18,454 | 5.81 | -5.10 | 27,806 | 4.79 | 32,462 | 5.95 | -14.34 |

| Bentley | 172 | 0.05 | 147 | 0.05 | 17.01 | 291 | 0.05 | 245 | 0.04 | 18.78 |

| BMW | 21,570 | 6.04 | 20,065 | 6.31 | 7.50 | 35,559 | 6.13 | 36,771 | 6.74 | -3.30 |

| BYD | 6,480 | 1.81 | 759 | 0.24 | 753.75 | 9,271 | 1.60 | 1,278 | 0.23 | 625.43 |

| Chevrolet | 10 | 0.00 | 1 | 0.00 | 900.00 | 27 | 0.00 | 1 | 0.00 | 2,600.00 |

| Citroen | 2,250 | 0.63 | 4,870 | 1.53 | -53.80 | 4,389 | 0.76 | 9,374 | 1.72 | -53.18 |

| Cupra | 6,182 | 1.73 | 3,982 | 1.25 | 55.25 | 10,032 | 1.73 | 6,983 | 1.28 | 43.66 |

| Dacia | 5,971 | 1.67 | 4,993 | 1.57 | 19.59 | 9,261 | 1.60 | 8,325 | 1.53 | 11.24 |

| DS | 75 | 0.02 | 184 | 0.06 | -59.24 | 198 | 0.03 | 370 | 0.07 | -46.49 |

| Fiat | 2,050 | 0.57 | 3,387 | 1.07 | -39.47 | 4,084 | 0.70 | 5,259 | 0.96 | -22.34 |

| Fisker | 0 | 0.00 | 10 | 0.00 | 0.00 | 0.00 | 207 | 0.04 | 0.00 | |

| Ford | 23,634 | 6.62 | 17,026 | 5.36 | 38.81 | 34,703 | 5.98 | 32,567 | 5.97 | 6.56 |

| Genesis | 214 | 0.06 | 141 | 0.04 | 51.77 | 419 | 0.07 | 218 | 0.04 | 92.20 |

| GWM | 29 | 0.01 | 310 | 0.10 | -90.65 | 86 | 0.01 | 422 | 0.08 | -79.62 |

| Honda | 5,851 | 1.64 | 7,919 | 2.49 | -26.11 | 8,902 | 1.53 | 12,182 | 2.23 | -26.92 |

| Hyundai | 14,443 | 4.04 | 13,570 | 4.27 | 6.43 | 24,886 | 4.29 | 23,480 | 4.30 | 5.99 |

| Ineos | 40 | 0.01 | 38 | 0.01 | 5.26 | 55 | 0.01 | 70 | 0.01 | -21.43 |

| Jaecoo | 1,786 | 0.50 | 0 | 0.00 | 0.00 | 3,235 | 0.56 | 0 | 0.00 | 0.00 |

| Jaguar | 736 | 0.21 | 4,690 | 1.48 | -84.31 | 1,725 | 0.30 | 6,759 | 1.24 | -74.48 |

| Jeep | 2,568 | 0.72 | 1,609 | 0.51 | 59.60 | 4,085 | 0.70 | 2,489 | 0.46 | 64.12 |

| KGM | 367 | 0.10 | 385 | 0.12 | -4.68 | 513 | 0.09 | 603 | 0.11 | -14.93 |

| Kia | 19,993 | 5.60 | 18,478 | 5.81 | 8.20 | 35,063 | 6.04 | 33,084 | 6.06 | 5.98 |

| Land Rover | 14,178 | 3.97 | 12,376 | 3.89 | 14.56 | 21,145 | 3.64 | 18,572 | 3.40 | 13.85 |

| Leapmotor | 193 | 0.05 | 0 | 0.00 | 0.00 | 193 | 0.03 | 0 | 0.00 | 0.00 |

| Lexus | 2,744 | 0.77 | 2,758 | 0.87 | -0.51 | 4,404 | 0.76 | 3,863 | 0.71 | 14.00 |

| Maserati | 65 | 0.02 | 91 | 0.03 | -28.57 | 102 | 0.02 | 156 | 0.03 | -34.62 |

| Maxus | 10 | 0.00 | 1 | 0.00 | 900.00 | 31 | 0.01 | 1 | 0.00 | 3,000.00 |

| Mazda | 6,889 | 1.93 | 4,628 | 1.46 | 48.85 | 10,996 | 1.89 | 7,467 | 1.37 | 47.26 |

| Mercedes-Benz | 17,664 | 4.95 | 19,794 | 6.23 | -10.76 | 27,415 | 4.72 | 28,543 | 5.23 | -3.95 |

| MG | 15,876 | 4.45 | 12,934 | 4.07 | 22.75 | 24,641 | 4.24 | 23,138 | 4.24 | 6.50 |

| MINI | 6,086 | 1.70 | 6,484 | 2.04 | -6.14 | 13,049 | 2.25 | 12,594 | 2.31 | 3.61 |

| Nissan | 16,778 | 4.70 | 20,559 | 6.47 | -18.39 | 27,855 | 4.80 | 33,403 | 6.12 | -16.61 |

| Omoda | 2,082 | 0.58 | 0.00 | 0.00 | 3,194 | 0.55 | 0.00 | 0.00 | ||

| Peugeot | 16,176 | 4.53 | 11,944 | 3.76 | 35.43 | 28,536 | 4.92 | 21,306 | 3.91 | 33.93 |

| Polestar | 2,434 | 0.68 | 803 | 0.25 | 203.11 | 3,695 | 0.64 | 1,298 | 0.24 | 184.67 |

| Porsche | 3,537 | 0.99 | 3,128 | 0.98 | 13.08 | 5,331 | 0.92 | 4,848 | 0.89 | 9.96 |

| Renault | 11,072 | 3.10 | 8,783 | 2.76 | 26.06 | 17,693 | 3.05 | 14,664 | 2.69 | 20.66 |

| SEAT | 4,038 | 1.13 | 6,041 | 1.90 | -33.16 | 6,953 | 1.20 | 11,150 | 2.04 | -37.64 |

| Skoda | 13,609 | 3.81 | 9,982 | 3.14 | 36.34 | 22,572 | 3.89 | 18,451 | 3.38 | 22.33 |

| Skywell | 6 | 0.00 | 0 | 0.00 | 0.00 | 7 | 0.00 | 0 | 0.00 | 0.00 |

| smart | 385 | 0.11 | 306 | 0.10 | 25.82 | 487 | 0.08 | 531 | 0.10 | -8.29 |

| Subaru | 627 | 0.18 | 641 | 0.20 | -2.18 | 825 | 0.14 | 899 | 0.16 | -8.23 |

| Suzuki | 3,387 | 0.95 | 5,049 | 1.59 | -32.92 | 5,925 | 1.02 | 7,676 | 1.41 | -22.81 |

| Tesla | 7,164 | 2.01 | 6,995 | 2.20 | 2.42 | 12,474 | 2.15 | 11,768 | 2.16 | 6.00 |

| Toyota | 18,516 | 5.19 | 16,886 | 5.31 | 9.65 | 26,144 | 4.50 | 26,193 | 4.80 | -0.19 |

| Vauxhall | 16,398 | 4.59 | 15,553 | 4.89 | 5.43 | 27,371 | 4.72 | 28,664 | 5.25 | -4.51 |

| Volkswagen | 31,562 | 8.84 | 22,147 | 6.97 | 42.51 | 53,156 | 9.16 | 41,331 | 7.58 | 28.61 |

| Volvo | 11,898 | 3.33 | 7,526 | 2.37 | 58.09 | 18,967 | 3.27 | 13,623 | 2.50 | 39.23 |

| Xpeng | 36 | 0.01 | 0 | 0.00 | 0.00 | 36 | 0.01 | 0 | 0.00 | 0.00 |

| Other British | 590 | 0.17 | 533 | 0.17 | 10.69 | 1,192 | 0.21 | 862 | 0.16 | 38.28 |

| Other Imports | 438 | 0.12 | 387 | 0.12 | 13.18 | 606 | 0.10 | 637 | 0.12 | -4.87 |

| Total | 357,103 | 317,786 | 12.37 | 580,502 | 545,548 | 6.41 | ||||

1 March 2019: 458,054 new car registrations

2 Autotrader: Average discount on BEVs, March 2025: 11.5%

3 From 1 April 2025, all new BEVs are subject to £10 VED in the first year of ownership, followed by annual VED of £195, currently, in years 2-6 (£975), for a total of £985. For BEVs more than £40,000, an additional £425 is currently charged annually in years 2-6 (£2,125) on top of standard VED, to give a total of £3,110.

4 Based on SMMT analysis

5 SMMT news release, Incentives needed to convert electric sceptics to EV benefits

SOURCE: SMMT