Tenneco Inc. (NYSE: TEN) reported record first quarter net income of $63 million, or $1.16 per diluted share, compared with $57 million, or 99-cents per diluted share in first quarter 2016. Adjusted net income increased 24% to a first quarter record high of $83 million, compared with $67 million last year. First quarter adjusted earnings per share also rose to a new record high of $1.53 per diluted share, a 31% improvement year-over-year.

Revenue

Total revenue in the first quarter was $2.292 billion, up 7% year-over-year, driven by higher revenue in both the Clean Air and Ride Performance product lines.

On a constant currency basis, total first quarter revenue increased 9% to $2.329 billion, outpacing industry production growth of 6%.* Record revenue in the quarter reflects an 11% increase in light vehicle revenue on the strength of the company’s global platform position. Commercial truck revenue increased 15%, outpacing industry growth of 5%. Off-highway revenue was about even with last year on continuing weak industry production. Global aftermarket revenue was also about even with a year ago.

In constant currency, value-add revenue increased 9% versus last year, and included 10% growth in Clean Air revenues, and 7% higher Ride Performance revenue.

“We started the year strong by delivering another record quarter with our highest-ever first quarter revenue, EBIT, net income and earnings per share,” said Gregg Sherrill, chairman and CEO Tenneco. “The strong balance across our business in terms of regions, end-markets, customers and products helped us deliver another quarter of profitable growth as we executed well on growth plans for each product line.”

Adjusted first quarter 2017 and 2016 results

| Q1 2017 | Q1 2016 | |||||||||||||||||

| (millions except per share amounts) | EBITDA* | EBIT | Net income attributable to Tenneco Inc. | Per Share | EBITDA* | EBIT | Net income attributable to Tenneco Inc. | Per Share | ||||||||||

| Earnings Measures | $ | 179 | $ | 127 | $ | 63 | $ | 1.16 | $ | 178 | $ | 124 | $ | 57 | $ | 0.99 | ||

| Adjustments (reflects non-GAAP measures): | ||||||||||||||||||

| Restructuring and related expenses | 14 | 15 | 14 | 0.25 | 11 | 14 | 13 | 0.23 | ||||||||||

| Pension Charges/stock vesting | 11 | 11 | 7 | 0.13 | – | – | – | – | ||||||||||

| Net tax adjustments | – | – | (1) | (0.01) | – | – | (3) | (0.05) | ||||||||||

| Non-GAAP earnings measures | $ | 204 | $ | 153 | $ | 83 | $ | 1.53 | $ | 189 | $ | 138 | $ | 67 | $ | 1.17 | ||

EBIT and EBIT Margin

First quarter EBIT (earnings before interest, taxes and noncontrolling interests) increased to $127 million, versus $124 million last year, and adjusted EBIT rose 11% to $153 million, both record highs for the first quarter.

Tenneco EBIT as a percent of revenue was 5.5% due to higher restructuring and other charges in the quarter. Adjusted EBIT as a percent of value-add revenue improved 30 basis points to 8.8%.

EBIT was driven by leveraging strong light vehicle volumes, strong commercial truck growth and continuing operational efficiencies. The year-over year comparison includes $4 million in negative currency.

First quarter EBIT margin

| Q1 2017 | Q1 2016 | |||

| EBIT as a percent of revenue | 5.5% | 5.8% | ||

| EBIT as a percent of value-add revenue | 7.3% | 7.6% | ||

| Adjusted EBIT as a percent of revenue | 6.7% | 6.5% | ||

| Adjusted EBIT as a percent of value-add revenue | 8.8% | 8.5% | ||

Cash

Cash used by operations in the quarter was $9 million, compared with a cash use of $29 million a year ago, driven by higher earnings and continued strong performance in accounts receivables, payables and inventories.

During the quarter, Tenneco repurchased 240,000 shares of common stock for $16 million. Since January 1, 2015, the company has repurchased a total of 8.7 million shares of common stock for $454 million.

In the first quarter, the company also paid a dividend of 25-cents per share, or $13 million.

OUTLOOK

Second quarter 2017

In the second quarter, Tenneco expects year-over-year revenue growth of approximately 5% on a constant currency basis, outpacing estimated light vehicle industry production growth* by four percentage points. Based on current exchange rates, the company anticipates approximately 2% currency headwind in the second quarter.

The company’s organic revenue growth is expected to be driven by Clean Air and Ride Performance content on top-selling light vehicle platforms globally; continued strong commercial truck growth; and a steady contribution from the global aftermarket.

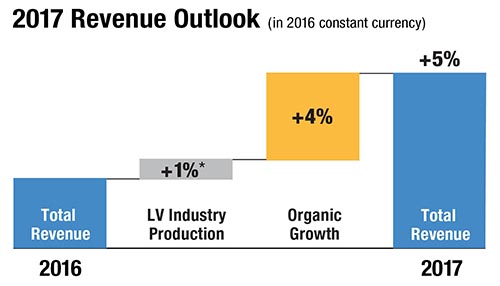

Full Year 2017

Tenneco also reaffirms its full-year revenue growth outlook announced in January. On a constant currency basis, the company expects year-over-year revenue growth of 5%, outpacing estimated light vehicle industry growth by 4 percentage points. The company also expects annual margin improvement in 2017.

Image

“Tenneco continues to have outstanding growth opportunities, supported by sustainable drivers and a technology portfolio aligned with positive market trends globally,” said Sherrill. “With distinct growth strategies for each product line, and our continuous improvement culture, we are making strong progress on our growth objectives and executing well to further drive higher earnings and improve profitability.”

*Source: IHS Automotive April 2017 global light vehicle production forecast and Tenneco estimates.

Click here to download Q1 2017 release including all attachments listed below

Attachment 1

Statements of Income – 3 Months

Balance Sheets

Statements of Cash Flows – 3 Months

Attachment 2

Reconciliation of GAAP Net Income to EBITDA including noncontrolling interests – 3 Months

Reconciliation of GAAP to Non-GAAP Earnings Measures – 3 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – 3 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – 3 Months

Reconciliation of Non-GAAP Measures – Debt Net of Cash/Adjusted LTM EBITDA including noncontrolling interests

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – Original Equipment and Aftermarket Revenue – 3 Months

Reconciliation of GAAP Revenue and Earnings to Non-GAAP Revenue and Earnings Measures – 3 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – Original Equipment Commercial Truck, Off-Highway and other revenues – 3 Months

CONFERENCE CALL

The company will host a conference call on Monday, May 1, 2017 at 10:00 a.m. ET. The dial-in number is 888-989-6519 (domestic) or 630-395-0180 (international). The passcode is TENNECO. The call and accompanying slides will be available on the financial section of the Tenneco web site at www.investors.tenneco.com. A recording of the call will be available one hour following completion of the call on May 1, 2017 through June 1, 2017. To access this recording, dial 800-937-4851 (domestic) or 203-369-3401 (international). The purpose of the call is to discuss the company’s operations for the first fiscal quarter of 2017, as well as provide updated information regarding matters impacting the company’s outlook. A copy of the press release is available on the financial and news sections of the Tenneco web site.

ANNUAL MEETING

The Tenneco Board of Directors has scheduled the corporation’s annual meeting of shareholders for Wednesday, May 17, 2017 at 10:00 a.m. CT. The meeting will be held at the corporate headquarters, 500 North Field Drive, Lake Forest, Illinois.