TOMTOM’S CHIEF EXECUTIVE OFFICER, HAROLD GODDIJN

“Market conditions continue to improve and we are pleased that our Automotive business shows robust sequential operational revenue growth.

Deal activity was strong despite COVID-19. We are especially excited to announce a multi-year expansion and extension of our Uber contract, supplying both maps and traffic. Uber will also become a map editing partner, deepening our relationship and enhancing our mapping ecosystem.

Research and development remain a priority, with further developments to our mapmaking platform, connected navigation product and our Maps APIs, laying the foundations for future success.”

OPERATIONAL SUMMARY

- A multi-year contract extension to provide maps, traffic and Maps APIs to Uber

- A new global deal to provide maps, navigation and traffic to Maserati

- A new product launch, RoadCheck, allowing for safer activation of automated driving functions

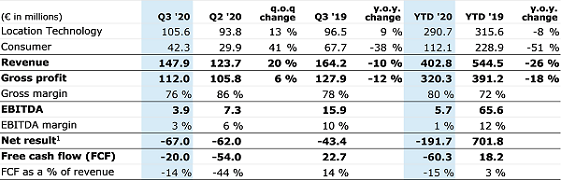

FINANCIAL SUMMARY THIRD QUARTER 2020

Compared with Q2 ’20

- Group revenue increased by 20% (Q2 ’20: €124 million)

- Location Technology increased by 13% (Q2 ’20: €94 million)

- Automotive operational revenue increased by 24% to €59 million (Q2 ’20: €48 million)

- Free cash flow is an outflow of €20 million (Q2 ’20: outflow of €54 million)

Compared with Q3 ’19

- Group revenue decreased by 10% (Q3 ’19: €164 million)

- Location Technology increased by 9% (Q3 ’19: €97 million)

- Automotive operational revenue decreased by 33% to €59 million (Q3 ’19: €88 million)

- Free cash flow is an outflow of €20 million (Q3 ’19: inflow of €23 million)

- Net cash of €346 million (Q3 ’19: €393 million)

KEY FIGURES

TOMTOM’S CHIEF FINANCIAL OFFICER, TACO TITULAER

“Sequential operational improvements in car production translated into 24% quarter on quarter revenue growth in Automotive. For Q4, we expect that Automotive operational revenue continues to show strong sequential growth. Full year reported revenue for the Group is expected to be around €530 million.

The start of new car lines in Automotive reduced gross margin this quarter. But we expect our gross margin for the full year to be around 80%.

Free cash flow in the quarter was in line with expectations. Seasonal customer receipts, combined with further improvements in Automotive operational revenue, will lead to positive free cash flow in Q4 ’20 of around €30 million.

Although there have been notable sales improvements in recent months, we feel that the economic circumstances remain too uncertain to resume our share buyback program at the moment.”

SOURCE: TomTom